QuickBooks payroll most common errors arise when users bask in the glory of the excellent QuickBooks functionality. Although the payroll feature offers numerous advantages and assistance, road bumps in the form of errors and glitches in its processing can adversely impact a user’s routine. However, there’s nothing to worry about when the ProAdvisor team is beside you with all the solutions and insights you’ll need to kick these errors out of your system.

While QuickBooks Payroll solves a user’s requirements regarding payroll computations, tax management, employee paycheck calculations, deposits, etc., it requires adequate user control through timely updates, ensuring accurate information, an active subscription, and proper setup. Although the expectations from the platform are high because of the excellent reviews, ease of usage, and seamless interface, bugs, glitches, and technical errors can creep in at any time to ruin the experience. Therefore, sufficient details about the causes, signs, and rectification methods are necessary to avoid such issues and make a user run QB payroll smoothly.

In this in-depth guide about the most common QB payroll errors, we will address the meaning, types, causes, signs, pre-measures, and troubleshooting solutions that must apply to rectify the problem from the origin.

If you have encountered the most common QuickBooks payroll errors while attempting a payroll activity or using any feature, you know how frustrating it can be to fix it. However, there’s no worry when you can contact our Proadvisor solutions’ representatives at 1.855.888.3080. You can let our proficient team handle everything you need without causing hurdles and obstacles

Table of Contents

What are QuickBooks Payroll Most Common Errors?

The most common QuickBooks Payroll errors & their solution arise when QuickBooks users send payroll data, submit their forms, deposit paychecks in employees’ accounts directly, finish payroll accounts, and undertake other payroll activities on the QuickBooks program. These errors correspond to the following payroll actions:

Incorrect or outdated tax tables

When utilizing QuickBooks payroll, you need up-to-date tax tables for accurate payroll taxes computations. If the tax tables are outdated or incorrect, inaccurate calculations and potential compliance issues can arise.

Missing or incorrect employee information

Payroll errors can occur when employee details like Social Security numbers, addresses, or tax withholding information are missing or entered incorrectly. These payroll errors lead to inaccurate tax calculations and payroll processing problems.

Incorrect pay rate or hours worked

QuickBooks users will see incorrect wages and payroll calculations if an employee’s pay rate or hours worked are entered incorrectly. Therefore, double-checking the entered data is critical to ensure accuracy.

Payroll liabilities not recorded or paid

The QuickBooks Payroll program tracks payroll liabilities such as taxes, benefits, and deductions so that users can have complete records with accurate details. However, users will encounter common errors and penalties when they fail to record or pay these liabilities on time.

Incorrect payroll tax settings

QuickBooks allows users to set up payroll tax items and rates, but incorrect configurations of these settings can mess up payroll, leading to inaccurate tax calculations and payroll errors.

Inconsistent pay periods or pay dates

When the pay periods or dates are inconsistent or not set correctly, users will notice that confusion spreads across the accounting records, and errors arise in payroll calculations.

Failure to update software or tax forms

QuickBooks regularly releases updates that address software bugs and tax form changes. So if you don’t update the software or tax forms, it can lead to payroll processing errors.

Improper handling of garnishments or deductions

QuickBooks allows for the setup of garnishments and deductions, such as child support or wage garnishments. If these are not set up correctly or mishandled, it can lead to payroll errors.

Incorrect state or local tax setup

If state or local tax rates are not set up accurately in QuickBooks, it can result in incorrect tax calculations and payroll errors.

Failure to reconcile payroll accounts

It’s important to reconcile payroll accounts in QuickBooks to ensure precision regularly. Failing to manage the accuracy of funds can lead to discrepancies and errors in payroll processing.

Thus, all these payroll issues can mess up how QuickBooks users function and accomplish payroll-related tasks. These screw-ups can cost them significantly when they fail to submit payroll timely, send faulty records to the IRS, failing to honor employees’ paychecks or facilitate inaccurate deductions.

Recommended to read : How to fix QuickBooks Error 2308

Most Common QuickBooks Payroll Error Codes and Descriptions

While earlier we mentioned the ways QuickBooks users could mess up their payroll and attract technical error notifications, this section will discuss the numerous QuickBooks desktop payroll errors, which might demand professional intervention, knowledge of the just causes, and troubleshooting solutions:

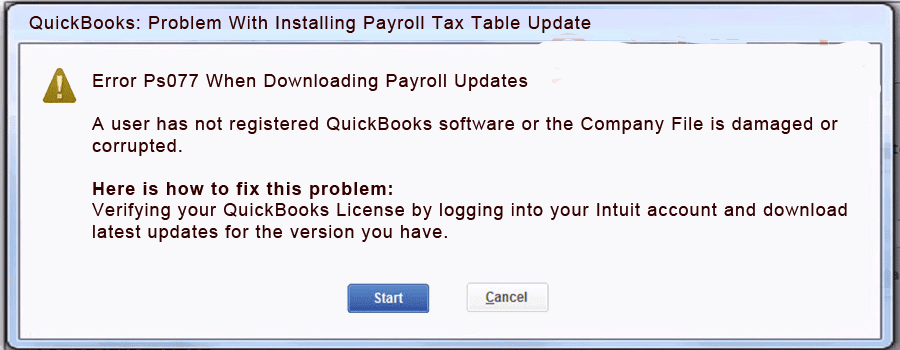

Error PS077 or PS032

These errors occur when issues with the QuickBooks Payroll tax table updates arise. An incomplete or missing update can create troubles, which can be rectified by downloading and installing the latest tax table updates. Further, an incorrect service key can also contribute to problems updating the latest payroll tax tables.

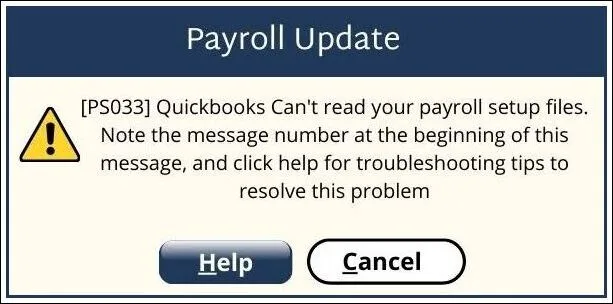

Error PS033

The PS033 QuickBooks error commonly occurs when the QuickBooks company file is damaged or missing. Users looking to fix the issue need to try renaming the CPS folder and then performing a clean installation of QuickBooks Payroll.

Error 15240

This error occurs when QuickBooks becomes incapable of updating itself due to an invalid or incorrect Digital Signature Certificate (DSC). Verifying the DSC settings and ensuring a stable internet connection can often settle this issue.

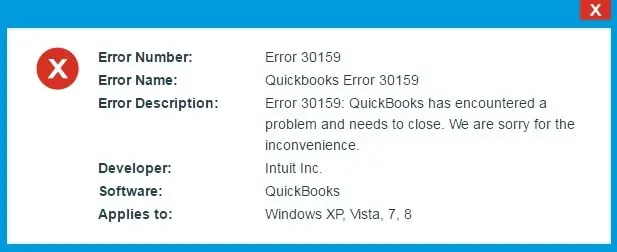

Error 30159

QuickBooks Error 30159 is associated with the incorrect setup of the QuickBooks Payroll tax table. Its resolution lies in correcting the EIN information and ensuring that the latest payroll updates are installed so you can operate QuickBooks Payroll without care.

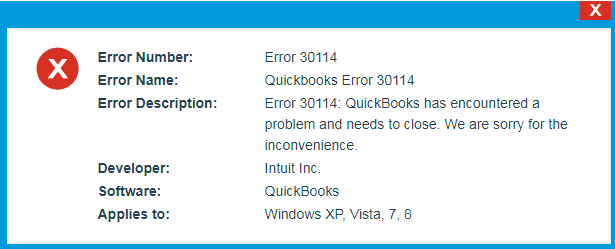

Error 30114

QuickBooks 30114 error occurs when there is an issue with the QuickBooks Payroll installation or a conflict with other software. For the rectification of this annoying issue, QB users need to repair the program’s installation files and ensure that all system requirements are met.

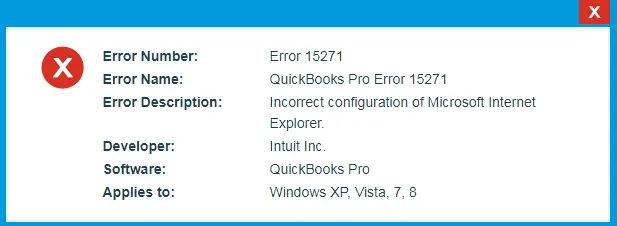

Error 15271

The 15271 QB error is related to issues with QuickBooks Payroll updates and can often be remedied by:

- Turning off User Account Control (UAC) settings

- Verifying the subscription details

- Ensuring that the latest updates are installed

Error 15243

The 15243 error occurs when QuickBooks is unable to download a payroll update. This error is resolved via the verification of Internet Explorer settings, checking the firewall and antivirus settings, and manually updating QuickBooks Payroll.

Other 15XXX-series errors

While we mentioned a few 15XXX-series errors above, many others exist in the QuickBooks Payroll curriculum and arise while performing payroll updates, operations, etc. The usual reasons for these errors lie in the following:

- The Shared Download Drive is not mapped accurately.

- The Internet Explorer settings stand incorrectly configured.

- A critical QuickBooks file or component facilitating QuickBooks Payroll updates doesn’t exist or is damaged.

- QuickBooks File Copy Services may be damaged.

- The QB program couldn’t verify digital signatures.

- Firewall restrictions have long been known to prevent QuickBooks connectivity and seamless functioning if it considers the app a threat.

Depending on the root origin of your error, you may receive a varied 15XXX series code. Consulting a QB representative, reviewing QB error documents, and other methods can enlighten you about the specific error code you receive and assist in resolving the problem.

Errors related to 12XXX-series

The 12XXX-series errors also occur in QuickBooks Payroll and cause glitches in payroll services due to internet connectivity and network timeout problems. These error codes include the number:

| QuickBooks error 12002 | QuickBooks error 12052 |

| QuickBooks error 12007 | QuickBooks error 12037 |

| QuickBooks error 12029 | QuickBooks error 12057 |

| QuickBooks error 12031 | QuickBooks error 12058 |

| QuickBooks error 12045 | QuickBooks error 12059 |

QuickBooks error 2170

The direct deposit feature in QuickBooks stops functioning or experiences glitches when error 2170 affects the system. Employers find it challenging to compensate their employees for their services due to the glitch arising because of the following reasons:

- The Windows Operating System they use to pay employees directly is corrupt.

- Their QuickBooks Desktop program may not be up-to-date.

- QuickBooks records critical for the transaction may get erased, removed, or deleted accidentally or intentionally.

These causes need attention so QuickBooks users can eliminate the error from their screens.

Read Also : How to use QuickBooks Data Migration Services

Other PSXXX-series errors

Although we’ve already discussed errors PS077, PS032, and PS033 earlier, various other PSXXX codes exist, indicating an issue with QuickBooks Payroll. In fact, the term ‘PS’ refers explicitly to payroll-related, so whenever users undergo PS101, PS107, PS036, and other such errors, they’re essentially encountering problems in running QuickBooks Payroll, its features, and updates.

The usual time of these errors is when QuickBooks users attempt to download payroll and tax table updates. The general causes of PSXXX errors attacking your system are as follows:

- Network and internet connection problems

- Restrictive Firewall Settings

- The CPS folder file might be damaged

- Damaged or missing files essential to undertake payroll updates

- Outdated company file used for payroll

- Incorrect or invalid EIN

- Failed to establish a connection with payroll servers

- Difficulties validating the subscription because of an invalid service key

Thus, the PSXXX errors need to be removed effectively so users can continue utilizing the program without hassle.

QuickBooks Payroll Connection Errors

Another common QuickBooks payroll error includes the following, which may arise while downloading payroll updates or depositing paychecks in your employees’ accounts via the direct deposit QB feature.

“Payroll Connection Error”

“Payroll Service Server Error. Please try again later. If this problem persists, please get in touch with Intuit Technical Support.”

The following triggers are responsible for getting these warnings on your screen:

- One primary issue is the frequent network timeouts arising while the program tries accessing Intuit server for updates.

- An invalid security certificate is another reason why QuickBooks users encounter payroll errors.

- Internet connection problems causing weak and slow functioning may be error-inducing.

- You can attract payroll errors if you send your payroll data while the multi-user mode is turned on.

- Firewall and personal security settings can block QB’s connection.

- Lastly, incorrect time and date cause the error to emerge on your screen.

Thus, targeting all these problems one by one will help you eliminate the possibility of payroll errors surrounding your screen.

General Causes for All QuickBooks Payroll Errors

The generic reasons why you encounter the different QuickBooks payroll errors are given below:

| Sr. No. | Basis | Meaning |

| 1. | Problems in Payroll Setup | QuickBooks payroll errors can occur if the QuickBooks Payroll software is not set up correctly. Thus, you’ll encounter issues while running or downloading payroll updates if you haven’t input correct employee information, tax information, or payroll preferences. This reason makes it crucial to ensure that all setup steps are followed accurately. |

| 2. | Old QuickBooks Version | A very common reason for glitches and bugs to arise in QuickBooks and running payroll is when the system doesn’t possess the bug fixes, software improvements, and security patches the new versions have. These compatibility errors and deficiencies in the current QB version attract payroll errors. |

| 3. | Internet Connectivity Problems | While working on QuickBooks Payroll, users must ensure they have a reliable and robust internet connection that allows them to download updates, transmit payroll data, and communicate with external services. Thus, users encountering network disruptions, slow internet speed, or firewall misconfigurations will need techniques to Fix QuickBooks Payroll Most Common Errors. |

| 4. | Corrupt Company File | A QuickBooks company file may be damaged due to sudden power outages causing system shutdowns, malicious virus attacks, and storage device problems. If, for any reason, QuickBooks company files required for payroll are damaged, it will invite payroll errors on your system. |

| 5. | Incorrect tax Table or Payroll Item Setup | Payroll errors can arise if the tax table is not updated or there are discrepancies in the payroll item setup. Thus, QB users must investigate and ensure that the tax table is regularly updated and all payroll items are accurately configured. |

| 6. | User Access Issues Or Permission Problems | Conducting payroll-related tasks and accessing relevant features require sufficient user permissions. For instance, administrators have the right to facilitate several operations. So, not possessing these privileges can attract QuickBooks payroll errors. |

| 7. | Conflicts with Other Applications | Some third-party services, programs, and QuickBooks add-ons may contradict QuickBooks’ functioning and prevent its seamless running, leading to common payroll errors. |

| 8. | Data Integrity Problems | QuickBooks Payroll errors can also occur due to data integrity problems within the company file, including duplicate entries, corruption, or payroll data inconsistencies. |

| 9. | Corrupt Windows Operating System | Specific QuickBooks payroll errors may also arise because of a corrupt, outdated, or damaged Windows OS, triggering compatibility problems in QB and payroll. |

| 10. | Sending Payroll While Multi-user Mode is Enabled | QuickBooks Payroll should be submitted only in single-user mode per the system requirements. However, if the multi-user mode is enabled while undertaking these operations, payroll errors are bound to arise. |

| 11. | Firewall Blockages | Whenever you encounter any QuickBooks payroll error, you must always verify your firewall and security software settings, as they may put QB in the ‘danger’ zone and cause errors to emerge. |

| 12. | Inaccurate Date and Time | QuickBooks payroll errors have an issue with incorrect system time and date properties. |

| 13. | Issues with Internet Explorer Settings | Like your firewall, your Internet Explorer may not consider Intuit and QuickBooks safe websites to visit, causing QB payroll errors while functioning. |

| 14. | Damaged CPS Folder | The files in your CPS folder or the folder itself may be damaged and trigger payroll errors. |

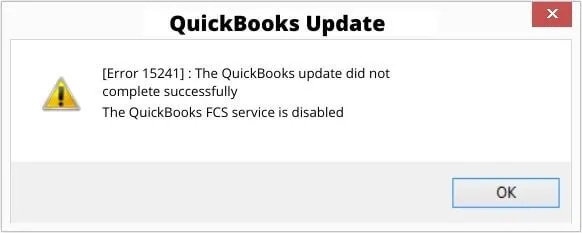

| 15. | Disabled FCS | File Copy Services (FCS) necessary for QuickBooks may malfunction, leading to payroll errors. |

Now that we have adequate information about why the most common QuickBooks payroll issues arise, we need to look into the signs and pre-measures preceding the troubleshooting.

Infection Signs of the Most Common Payroll Errors

Here’s how to confirm the presence of the most common payroll errors in QB infecting your system:

- Discrepancies in calculations, payroll hours, paycheck computations, taxes, etc., may emerge, pushing QuickBooks users toward significant legal troubles.

- Payroll errors can trigger discrepancies in tax withholdings, like incorrect federal or state tax amounts getting deducted from employee paychecks.

- Inaccurate computations of payroll liabilities, like employer taxes, paychecks, etc., can indicate the presence of payroll errors.

- Specific error messages mentioned above or other payroll-related warnings can inform you of the wrath of payroll glitches in QB.

- The payroll updates that you download are not successful because of the annoying errors.

- You won’t be successful while attempting to direct deposit paychecks in employees’ accounts.

- Reconciliation discrepancies, inaccurate reports, and legal and tax implications are other horrors of QuickBooks payroll errors.

Thus, QB users need a robust escape from the wrath of the annoying QuickBooks payroll errors. That is why we have detailed the resolution procedure with pre-considerations to make troubleshooting smooth and accessible.

Pre-considerations To Manage QuickBooks Payroll Errors

Some pre-considerations before you step into the world to Resolve QuickBooks Payroll Most Common Errors are as follows:

- Verify your current QuickBooks release via the product Information Window (F2 or Ctrl + 1) in QB to satisfy that you’re not using an old release.

- Similarly, confirm your payroll tax table updates from the Employees menu and payroll information. A section named You are using tax table version will be available to give you the critical data.

- Look into your network and internet connectivity, test your connection’s strength, and ensure the speed is fast and robust.

- Match the system requirements with your QuickBooks functioning and ensure compatibility between the two components.

- Look at the access permissions, user access level, and such details, and run QB as administrator to undertake QuickBooks payroll and tax table updates successfully.

- Examine your employee information, billing details, payroll items, company preferences, and all such information having the potential to cause errors in payroll.

- Review your QuickBooks payroll subscription status and activate it if it’s not already.

- Do not forget that your files need protection and security, and if any troubleshooting step threatens their integrity, you can safeguard them by backing them up.

- Let official resources and QuickBooks documentation support you wherever required.

Once you confirm all these details, you can pleasantly move forward with the rectification of the most common QuickBooks Payroll errors.

Troubleshooting Approaches to Fix the Most Common QuickBooks Payroll Errors

We have finally arrived at the point where we can learn to solve Intuit Payroll related most common errors seamlessly:

Troubleshooting Approach #1: Turn Off the User Account Control Settings in Windows

Although Windows’s User Account Control (UAC) settings are crucial from a security perspective, you might need to turn it off when QuickBooks Payroll’s most common errors arise. The steps involved in turning off UAC are mentioned below:

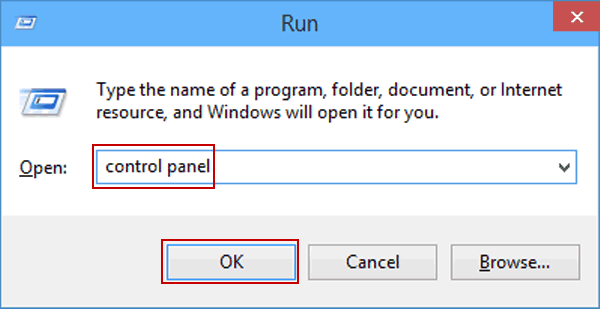

Step 1: Unfurl the Control Panel

The primary thing to undertake this solution involves launching the Control Panel via the Windows key on your keyboard. It will unlock the Start menu, where you need to type “Control Panel” and pick it from the search outcomes.

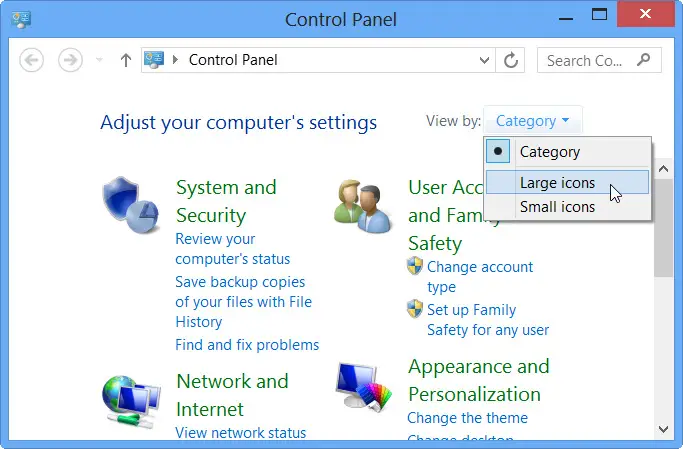

Step 2: Change the Control Panel view (if necessary)

Ensure the Control Panel is in either the “Category” or “Large icons” view. If you have the settings arranged to “Small icons,” tap the drop-down menu next to “View by” and opt for either “Category” or “Large icons” to adjust them according to your requirements.

Step 3: Open User Accounts

When you access the Control Panel, discover the “User Accounts” option and move forward with it.

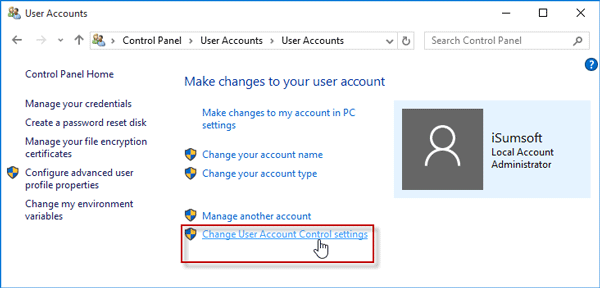

Step 4: Alter the User Account Control settings

Now, you must hit the “Change User Account Control settings” link within the User Accounts window.

Step 5: Revise the UAC settings

You will see a vertical slider with different levels of UAC settings for your requirements. By default, it is set to a level that notifies you when programs make changes to your computer. So to disable UAC, move the slider down to the “Never notify” position.

Step 6: Confirm the changes

After shifting the slider to your desired level, you can validate the modifications by clicking the “OK” button.

Step 7: Conclude with a Restart

You can make sure the changes get implemented after you let the restart button run on your device. However, you must also take care of your files by saving any open ones and closing all programs.

Troubleshooting Approach #2: Fix the Outdated QB and Payroll Tax Table Issue

An outdated QuickBooks payroll and tax table issue can be rectified by downloading and installing their respective updates. Since an old version becomes incapable of dealing with several bugs and requires immediate fixes, resolving these issues requires taking the following steps:

Step 1: Launch QuickBooks

Your direct action to update QB requires launching it on your computer by double-clicking its icon on the desktop or from All Programs.

Step 2: Explore New QuickBooks updates

The next action needs you to see if any new updates are available, which you can do from the “Help” menu at the top. There, proceed with the “Update QuickBooks Desktop” button. When the latest version gets into your system successfully, you will be informed via a wizard stating, “You are up to date!” However, in other cases, when you tap the “Update Now” button, you will encounter the journey of the entire procedure on your screen.

Step 3: Opt for updates to install

QuickBooks will show a list of updates and their descriptions, if any are available. Review them thoroughly and pick the ones you wish to install. However, experts recommend you opt for all available updates to ensure you have the latest features and bug fixes.

Step 4: Click on “Get Updates”

After selecting the desired updates, get these updates via the “Get Updates” button. This command will prompt QB to commence downloading and installing the updates. The waiting time may be prolonged if your internet connection is slow or the update size is extensive.

Step 5: Restart QuickBooks

A successful installation message will appear to inform you the update has finished without hassle. You can proceed by hitting the “Close” button, exiting the system, and rebooting QuickBooks to implement the updates.

Step 6: Check for payroll tax table updates

Once your QB program is up-to-date, you can move your sight to the payroll tax tables and their conditions. The payroll tax table updates will appear in the “Employees” menu at the top. One more step involves clicking “Get Payroll Updates.”

Step 7: Select the download method

When the payroll updates emerge on the screen, and you know you need the latest one for your payroll calculations, select the appropriate download method in the “Get Payroll Updates” window. If you have an internet connection, choose “Download Entire Update” and click “Update” to commence our purpose.

Step 8: Let the update finish

QuickBooks will download and install the latest payroll tax table update in its own time, containing the latest tax rates, forms, and calculations needed for accurate payroll processing.

Step 9: Verify successful update

After the QuickBooks payroll tax table update, you will witness a message demonstrating the victorious installation of the payroll tax table update. You can shut down this message by tapping “OK.”

Step 10: Perform a test run

It’s recommended to perform a test run of payroll to ensure that the updated tax tables and calculations are working correctly and the installation has been completed and not partial. The test can involve creating a sample paycheck and reviewing the deductions, withholdings, and calculations to confirm accuracy.

Troubleshooting Approach #3: Use QuickBooks Tool Hub Tools

QuickBooks Tool Hub gives several utilities like Quick Fix My Program and QuickBooks Install Diagnostic Tool to repair problems regarding the program’s performance, installation files, etc. The following detailed insights will assist you in scanning via these tools:

Step 1: Follow the Download and Installation Procedure for the QuickBooks Tools Hub

The QuickBooks Tool Hub solution begins with insights into downloading and installing this utility. It involves visiting the official QuickBooks website and exploring the sections for “QuickBooks Tools Hub.”

Once you find the latest tool hub installer package, download it and respond to all the instructions that guide you to install it successfully on your computer.

Step 2: Uncover the QuickBooks Tools Hub

When the QB Tool Hub download and installation ends, the procedure of opening and using its utility begins. Thus, locate the tool hub icon or file wherever you have saved it in your system and double-tap it to commence its usage.

Step 3: Select the appropriate tool

As the QuickBooks Tools Hub unfurls, you’ll arrive at a place filled with a variety of tools to troubleshoot different types of issues. However, it would help to investigate the path for a relevant tool for your problem. For example, select the “Installation Issues” tab if you’re facing installation issues. Similarly, pick “Program Problems” when your application troubles you with its performance.

Step 4: Run the tool

Once you navigate the respective tabs for your problems, you’ll find the options to Start Scanning with the tools. For instance, Installation issues contain QuickBooks Install Diagnostic Tool, and Program Problems have Quick Fix My Program. So, choose one and let all the wizards flash on the screen so you can respond appropriately.

Step 5: Review the results

Once the tool completes its analysis, it will exhibit the results of the troubleshooting process. You may find instructions on how to fix the issue on your screen in the tool results window, or further actions might be suggested.

Step 6: Repeat or try other tools if necessary

If the payroll errors persist or the first tool doesn’t resolve the problem, you can try other tools available in the QuickBooks Tools Hub package. Opt for any and run it in a similar way to get the required results.

Bottom Line

With these details, we end this thorough blog on QuickBooks payroll most common errors. However, additional assistance is available at our 1.855.888.3080 for you to contact us as necessary.

FAQs

How do I prevent the most common QuickBooks payroll errors from arising?

You can make sure to avoid the most common QB payroll errors by verifying the following details:

1. Keeping a robust internet connection.

2. Ensuring the input of correct details in the payroll.

3. Maintaining an active payroll subscription.

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.