QuickBooks is the most used accounting application worldwide. The wide range of tools and features offered by the application pushes its popularity even further. The users need to generate financial reports to understand the health and functioning of their businesses. QuickBooks provides easy tools to generate and customize these reports. The Profit and Loss report shows the company’s performance and sustainability over a certain period. It provides the information of the profit that the company earned or the loss that it incurred. It is a very crucial report but you may get QuickBooks Profit and Loss report wrong due to various issues. This article will discuss the reasons why you may get incorrect Profit and Loss report in QuickBooks. We will also explain you the troubleshooting methods to resolve the issue.

“If you get QuickBooks Profit and Loss report wrong issue and need an expert’s help for its resolution, contact QuickBooks Accounting Support at 1-(855)-856-0042”

You may also see: How to Change QuickBooks License Number

Table of Contents

Reasons that bring Discrepancies in QuickBooks P&L Reports

The reasons that can bring discrepancies in QuickBooks P&L reports can be a human error or a technical issue. If the data entered to create the report was incorrect, it is bound to produce inaccurate results. Besides this, there are some other reasons as well that can cause QuickBooks Profit and Loss report wrong issue. These are as follows:

- When you select a different date range than you need to, you will get unexpected figures.

- If you have generated the report on different bases, the P&L report can get discrepancies.

- Fetching the wrong sales account to generate the report will provide erroneous outcomes.

- If you have not used items in the transaction, the P&L report can get issues.

- Incorrect entries made in any accounts generate the wrong report.

Understanding the reasons behind any issue makes it easier for us to resolve it. Keep reading the article to know about the troubleshooting methods.

How to Rectify Incorrect Profit and Loss Reports in QuickBooks?

As we understand now that there are various possible reasons if you are getting incorrect Profit and Loss reports. The troubleshooting methods that can be applied to resolve the issue depends primarily on the reasons causing it. Here, we have provided you the different methods that can effectively resolve the issue. You should apply the method depending on the reason causing it but if you are not sure, follow the order as provided below:

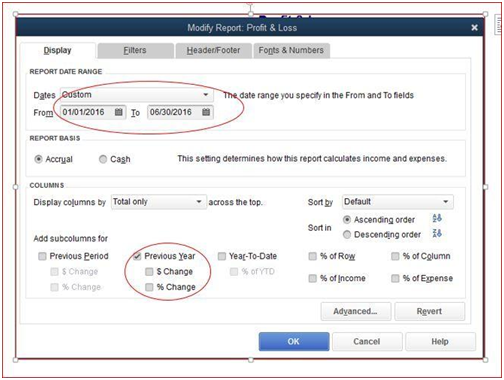

Method 1: Correcting the Date Range if P&L Statement Incorrect in QuickBooks

You can get the P&L statement incorrect in QuickBooks because of selecting the incorrect date range. It can be resolved by selecting the right date range of the report. Follow the steps as provided below:

- Open your QuickBooks application and click on the ‘Reports’ menu.

- Click on the ‘Customize report’ option and then click on ‘Dates.’

- Click on ‘All’ from the drop-down menu and click on ‘Report basis’ to change it to ‘Accrual.’

- Press the ‘OK’ button to save the changes and generate a new report.

Method 2: Selecting the Correct Account to Fix QuickBooks Profit and Loss Report Wrong

If you have selected the wrong sales items account to prepare the report, it will yield wrong results. You should check that you have selected the right account, and make changes if necessary. Follow the steps given below to rectify the issue:

- Go to the ‘Lists’ menu of your QuickBooks application.

- Select the ‘Item List’ option.

- Right-click on the new screen and select ‘Customize Columns’ in the new window.

- Make sure that you have selected the ‘Account’ and ‘Cost Account’ column.

- Verify that each sale item is attached with the correct account.

- If you find any item linked with an incorrect account, change it.

- Generate a new report now and check if it’s accurate.

If the error persists, then keep reading the article for the next method.

Method 3: Check the Transactions that don’t Use Items

Transactions that do not use items can produce incorrect Profit and Loss reports in QuickBooks. Ensure that there is no such transaction present in the report. Follow the steps as provided below:

- Start by generating a P&L report selecting ‘Basis’ for ‘Accrual’ and ‘All’ in ‘Date.’

- Double-click on the amount to zoom in.

- Go to the ‘Detail Report’ section and click on the ‘Total By’ option.

- Change it to ‘Item’ and run the report again.

- Go down the report to assess the number of transactions and check if the issue is resolved.

If you are still struggling with the error, you would need to open the P&L report and the Sales report to look for the faulty transaction or any other issue causing the error.

Method 4: Analyzing the Financial Reports Manually

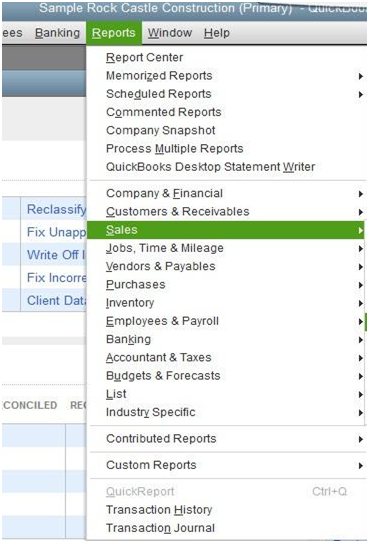

- Open your QuickBooks application and go to the ‘Reports’ menu.

- You can open the P&L report or the Sales report by selecting the option and the necessary customization.

- Double-click on the report after running it to rivet.

- Choose the Entire by to Item.

- You should stick with the detail reports and match them individually to seek discrepancies.

- If the alignment is not suitable, click on the ‘Windows’ tab and then click on the option ‘Tile Vertically.’

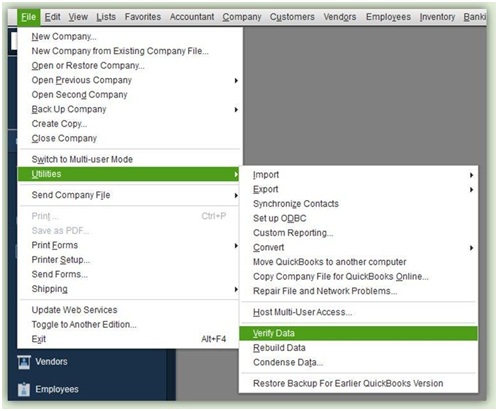

If you fail to identify any issues through this method as well, you should consider a possible Company file corruption. You can use the Verify and Rebuild Data Utility of QuickBooks to resolve your file corruption.

You may also read: How to merge QuickBooks company files

These processes should help you get rid of the issues in your P&L report. We discussed the various reasons that may bring about QuickBooks Profit and Loss report wrong in this article. We also explained to you its troubleshooting methods. If you fail to resolve the issue or you feel the need for an expert for resolution, you can contact QuickBooks Technical Support at 1-(855)-856-0042.