QuickBooks Error 3180 can emerge during a financial exchange between the QuickBooks Desktop and QuickBooks Point of Sale applications. Due to this 3000-series error, users may encounter error messages disrupting the process. Let’s look into ways you can get rid of this issue without getting stuck in a hassle.

QuickBooks provides user-centric solutions for all accounting-related business processes. The advanced add-on tool, QuickBooks POS, is built for retail businesses. Contactless payment-receiving options, advanced inventory management, and seamless e-commerce integration are some major attractions of this application. While it offers these great features, it is not free of errors. You can get a QuickBooks Status code 3180 error while working on QuickBooks Desktop, Payroll, or POS. Through this article, we will try to analyze the various reasons that can cause the error and also the applicable troubleshooting methods.

“Has QuickBooks Error 3180 made it challenging for your to proceed with your operations? Contact our Support Team at 1-(855)-856-0042 for professional views and assistance with the issue”

You may also see: QuickBooks status code 3170

Table of Contents

What is Error Code 3180 in QuickBooks?

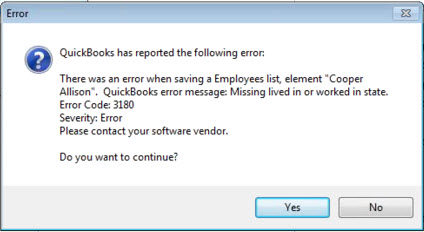

Error code 3180 in QuickBooks POS is a series 3000 error. These errors are concerned with financial exchanges between the QuickBooks Desktop Point of Sales application and the QuickBooks Desktop application. It may appear with different error messages such as:

“Sales tax detail line must have a vendor,”

Or,

“There was an error when saving an Employee list, element ‘Employee, Name’”

These messages appear due to various reasons and would require specific troubleshooting methods for resolution.

Common Reasons that Triggers QuickBooks Error 3180

Let us analyze the reasons behind the error code 3180 there was an error saving a data that users may experience while using QuickBooks. This would help us resolve the error efficiently.

- The sales tax items in the QuickBooks Desktop might not be linked with any of the vendors.

- The account mapping of the sales tax payable account might be incorrect.

- You might have created a paid-out for the sales tax payable account.

- Your sales tax payable account might be the target account for more than one item on receipts.

- The type of payment item might be incorrect or damaged.

- QuickBooks error saving employee lists might emerge due to using the wrong QuickBooks Desktop account type while mapping accounts in QuickBooks POS.

- The antivirus app on the system might cause this issue to emerge.

- There might be a possibility of a damaged or corrupted QuickBooks company file causing this issue.

- Incorrect/ improper QuickBooks settings related to the tax form, sales tax, etc., as follows:

– Usually, Company preferences show the use of the Sales Tax, but company information has not been set up correctly this time to use a particular tax form.

– The tax agency vendor might not be set to a particular type.

– A tax type is not set up for accounts being interfaced. - Improper QB installation might lead to QuickBooks error saving time tracking.

- Faults in the Windows registry can also lead to this issue.

Signs and Symptoms of QuickBooks Error 3180

When QuickBooks error 3180 infects a system, the following things begin happening with the user:

- Users might face challenges in saving their sales receipts.

- The keyboard and mouse commands do not get a timely response.

- Windows starts performing sluggishly, affecting other active programs as well.

- QuickBooks and QB POS might crash and close automatically.

- You will see an error message with a specific message and description appearing on the screen.

Types of QuickBooks Error 3180 and their Troubleshooting Methods

The QuickBooks status message 3180 might appear in the following ways on a user’s screen and lead to the following issues. Users can resolve them with the appropriate methods mentioned below or general troubleshooting instructions in the end.

Status Code 3180: Problem with Saving the General Journal Transaction

Users may get the QuickBooks Status code 3180 in QuickBooks Desktop or QuickBooks Point of Sales. It appears with the error message “There was a problem with saving the General Journal Transaction.” It may occur due to the following reasons:

- Damaged voucher can cause the error.

- Shown mapped account on sale of items is incorrect.

- Items are linked to an inactive account.

- If the account is deleted, then also it can prompt the error.

To resolve the error, you should recreate the voucher and then recheck the accounts. Follow the steps as provided below:

- You need to reverse the voucher.

- Re-create it correctly and then run the financial exchange.

- To recheck the accounts, go to the ‘Home’ page and select ‘Sales History.’

- Observe all the affected items and note them.

- Now, go to Home > Item List > Edit.

- Ensure that the account mapping is set up properly under the QuickBooks option.

- Also, ensure that the affected accounts are active.

- Click on the ‘Save’ button and then run financial exchange.

QuickBooks Error Message: The Posting Account is Invalid

You may encounter the error message “Status code 3180: QuickBooks error message: The Posting account is invalid”. It happens when the wrong type of QuickBooks Desktop account is used in account mapping in QuickBooks POS. The issue can be resolved by slight maneuvering of accounts in QuickBooks Desktop and POS. The steps are as follows:

In QuickBooks Desktop Point of Sale

- Go to the ‘File’ menu, and then select ‘Preferences.’

- Click on ‘Company’ followed by ‘Accounts’ under the ‘Financial’ section.

- Check both ‘Basic’ and ‘Advanced’ tabs and make sure that accounts are correctly mapped.

- Press the ‘Save’ button and run the financial exchange.

In QuickBooks Desktop

- Select ‘Item List’ from the ‘List’ menu.

- You will need to check all the items in the list to ensure that every item is using the appropriate account.

- Run Financial exchange.

Changing the name and creating each financial method again

- When you open your QuickBooks Desktop, go to the Lists menu.

- Here, select the Customer & Vendor Profile Lists option.

- Now, choose the Payment Method List button.

- Right-click the Cash method and choose the option to Edit Payment Method.

- You need to add the letter X to the Payment Method Field, which will appear like (XCash), and choose OK.

- Further, right-click the Cash method again and select New.

- Keep its name as Cash and now operate the financial exchange.

- If you deem it necessary, repeat the same steps for all the payment methods so they get renamed and re-created.

Status message: Sales Tax Detail Line must have a Vendor

When you go on to save a Sales Receipt (or Credit Memo), you may get the error message saying “QuickBooks error message: Sales tax detail line must have a vendor.” Let us analyze the reasons why this occurs:

- If the sales tax item is not associated with any vendor.

- Account mapping for sales tax payable account is incorrect.

- If one or more receipt items have the sales tax payable account selected as the target account.

- In case the sales tax payable account is used to create a paid out.

To resolve the error, you need to perform the following steps to assign a vendor to the sales tax item:

- Reach the ‘Lists’ menu in your QuickBooks Desktop application.

- Select the ‘Item List’ option.

- Select the ‘Include Inactive’ option and then reach the ‘Type’ header.

- Ensure that a tax agency is attached to all sales tax item.

Now you need to check the tax preference in your QuickBooks POS through the following steps:

- Click on ‘File,’ select ‘Preferences.’

- Click on ‘Company’ and then ‘Accounts’ under the ‘Financial’ section.

- Go to both the ‘Basic’ and ‘Advanced’ tabs and ensure that QB sales tax payable is listed as ‘Only’ in the sales tax row.

- Change it to ‘Only’ for entries that don’t have it and then run the financial exchange.

Next, ensure the problem receipt does not get paid out using sales tax payable:

- When you open the QuickBooks Point of Sale, choose the option to open Sales History.

- Here, right-click any column and hit the option that says Customize Columns.

- Ensure to select the QB status.

- Now, browse for receipts that haven’t been completed yet. If any of these receipts have been paid out to the sales tax payable, choose the receipt and then hit the Reverse receipt option.

- Now, you need to recreate the paid-out through a non-sales tax payable account and run the financial exchange.

You may also read: QuickBooks warning Windows updates not installed

Status Code 3180: Status Message: There was an Error while Saving a Sales Receipt

When there’s a damaged payment item or the wrong type of item while running a financial exchange, users may encounter the QuickBooks error 3180. In such circumstances, the following troubleshooting methods should get applied to fix the issue:

- Open your QuickBooks Desktop and visit the Lists menu.

- Select the Item List option and choose the Include Inactive icon.

- Hit the Type header for sorting the list.

- Now, you need to change the name of the Point of Sale payment items. The steps for it include:

– Right-click the payment item that begins with the text “POS”.

– Choose the option to Edit items.

– You need to add OLD to the payment item. For instance, OLD POS Visa Credit Card.

– Choose OK to apply the changes. - Now, you need to run the financial exchange from your Point of Sale.

Also, you need to merge the items that are duplicated in the QB Desktop as follows:

- Right-click the payment where you added OLD and then hit the Edit item option.

- Remove the text “OLD” added earlier and choose OK.

- QB Desktop will flash a prompt asking you to merge the items.

- Choose Yes to confirm this action.

Status code 3180: …QuickBooks error message: A/P (or A/R) detail line must have vendor

Users encounter this error usually when they use QuickBooks Desktop accounts receivable or payable to create a paid out in the QuickBooks Desktop Point of Sale. When this error appears, it indicates incorrect settings in QB. The error messages that might appear in this case are as follows:

- There was an error when saving a General Journal transaction. QuickBooks error message: A/P detail line must have a vendor.

- There was an error when saving a General Journal transaction. QuickBooks error message: A/R detail line must have a vendor.

You can try rectifying this problem as follows:

- Visit the home page of the QuickBooks Point Of Sale.

- Here, choose the section that says Sales History.

- Go to the Receipt Type column and opt for the most recent receipt, which would be tagged as Payout.

- Now, hit Reverse from the ‘I Want to…’ drop-down.

- Lastly, re-create the Paid Out using an account other than the accounts receivable or accounts payable.

Through this article, we discussed QuickBooks Error 3180 and explained you the reasons causing the error as well as its methods of resolution. You should follow the steps provided above to resolve the error easily if it occurs. If you are struggling and you need help from an expert to get rid of it, then QuickBooks Technical Support at 1-(855)-856-0042.