QuickBooks Payroll allows you to handle your employee paychecks while complying with the taxes. Isn’t it amazing! Well, millions of users worldwide have appreciated QuickBooks Payroll for the same. However, during one such task of trying to send payroll or direct deposit paychecks, you may see the QuickBooks payroll error 2002. In such a scenario, we suggest using this blog as your guide to solve the error.

If you have tried fixing it manually or want a quick way out of this payroll error, then contact the support team on +1.855.888.3080.

Table of Contents

Main Reasons Why You’re Seeing QuickBooks Payroll Error 2002

An error can root for various reasons. You can sometimes study the causes, and the reason is unknown in certain instances. Let us look at some reasons that have been quite prominent in causing QuickBooks Error 2002.

- The security certificate is invalid.

- You are trying to send the payroll data while in the multi-user mode.

- Another reason for QuickBooks payroll error 2002 is the network time out that hinders QuickBooks Desktop from establishing a connection with the server.

- Issues or glitches with your internet connectivity can also result in this payroll error.

- The Internet security and personal firewall software settings are not compatible to allow the download of the updates.

- Your system’s date and time are incorrect.

You may read also: QuickBooks Error PS036

Symptoms You’ll Notice with QuickBooks Payroll Error Code 2002

To fix an error on time, it is essential to realize its early signs. This section will help you know the signs and symptoms of QuickBooks Payroll connection server error 2002.

- You may observe that your system is unresponsive. In addition, it may shut down without warning.

- Windows responds slowly to mouse and keyboard inputs.

- QuickBooks disrupts the working on other applications.

- Your QuickBooks data file won’t open up.

Steps to Fix QuickBooks Error Code 2002 in Payroll

After looking at the symptoms and the reasons for QuickBooks Error 2002, we will finally examine how to fix it. There are various ways to do so, and you must follow them one by one until you can eliminate the error.

Method 1: Update QuickBooks Payroll Tax Table

Now before you start updating your payroll tax table, you must be subscribed to QuickBooks Desktop Payroll. In addition, it is vital that every time you pay your employees, you must update your tax table.

Let us first use the steps below to see if your tax table is updated or not.

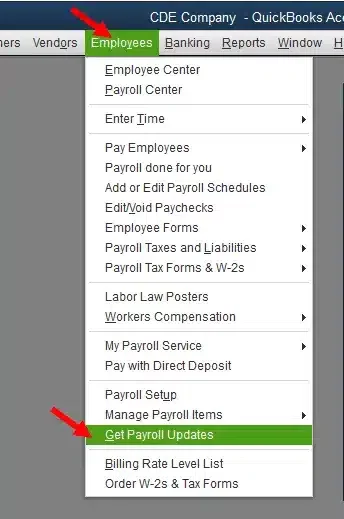

- Click on Employees.

- Choose the Get Payroll Updates option.

- Click on Payroll Update Info.

- You must check if the tax table is updated to the latest version.

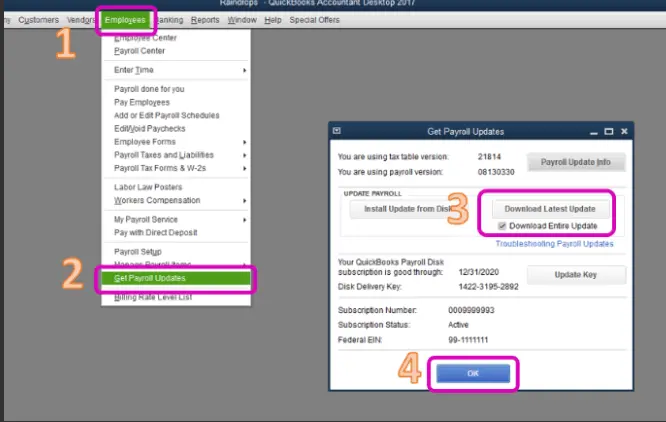

If the QuickBooks Payroll tax table is not updated, you must download it using the steps below.

- Click on Employees, then choose the Get Payroll Updates option.

- You must click on the Download Entire Update checkbox.

- Now choose the Download Latest Update option.

- The download process will start, and a window with the specific information will appear once it is complete.

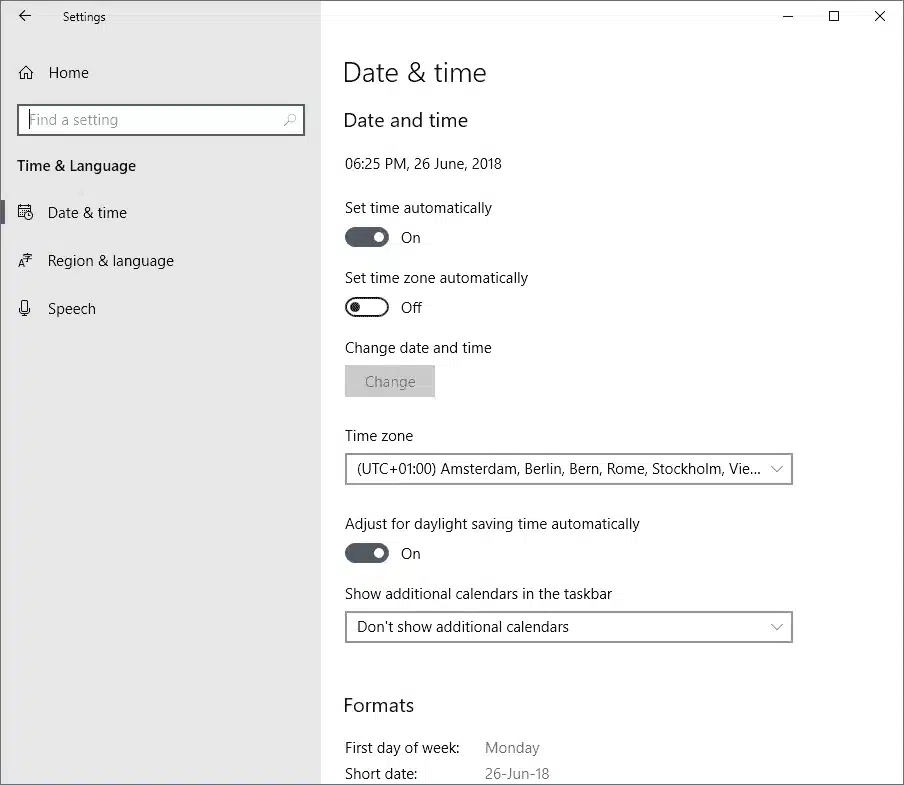

Method 2: Update your system’s date and time

If your system has an outdated time and date, then you must update it. If you are unsure how to do this process, here is a guide for the same.

- Click on the Start button on your desktop.

- Navigate to the option of Settings.

- Click on Time & language and then Date & time.

- Now you have the ability to correct the Date and Time if they are incorrect.

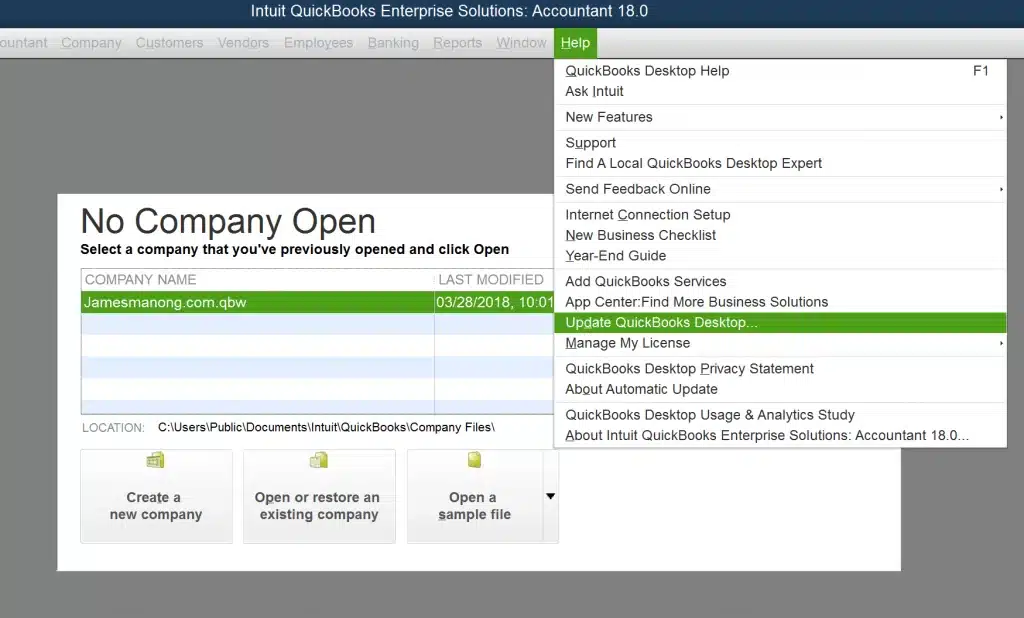

Method 3: Update the QuickBooks application manually

When facing an error in an application, it is always suggested by experts to update it manually. This ensures that recently released updates can fix minor glitches in the app. Hence, if you could not fix QuickBooks Payroll error code 2002 by following the solution above, this method of manually updating QuickBooks may help.

- First, close the QuickBooks application and your data file.

- Once you see that no other program is running, click on the Start icon on your desktop.

- In the search bar, type QuickBooks Desktop and right-click on your application version.

- From the drop-down menu, choose Run as administrator.

- This will launch the No Company Open screen window.

- Now, click on the Help menu and choose Update QuickBooks Desktop.

- Press the Options tab.

- Select Mark All and then press the Save button.

- Move ahead and click on the Update Now tab.

- You will observe a checkbox next to the Reset Update option. Select it by clicking on it.

- At last, use the Get Updates option to initiate the process of updating.

- After you manually update QuickBooks.

- Hit on the Yes button.

You may see also: QuickBooks Error PS107

Method 4: Review your State Unemployment Insurance (SUI) rate

State Employment Insurance Rate is a value by your state. Additionally, this value is unique to every business. Updating the SUI rate if it is changed can help fix QuickBooks payroll error code 2002.

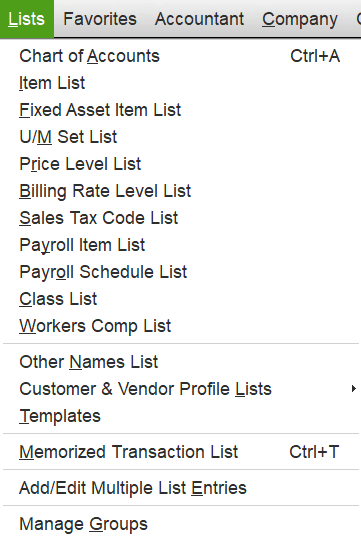

- Navigate to the Lists menu.

- Select Payroll Item List and click twice on [state abbreviation] – Unemployment Company.

- Hit on the Next button and keep doing it until you reach the Company tax rates screen.

- Enter the modified SUI Rate.

- Pres Next and then Finish.

In case of non-updated additional rates

You must review any surcharge or assessment for state unemployment that is not updated in your QuickBooks payroll and accomplish the same. Here are the steps you must follow in case of these non-updated additional rates.

- First, navigate to the Lists menu.

- Select the Payroll Item List option.

- Now you must double-click on the State Surcharge item.

- This is to be followed by clicking on the Next button.

- From here, instructions on the screen will guide you, and by following the steps as they appear, you will reach the Company Tax Rate window.

- The additional rate is to be filled in as a percentage.

Concluding…

And this ends the blog on QuickBooks Payroll Error 2002. We hope the above methods served their purpose of eliminating the error from QuickBooks Payroll, and you could send payroll or direct paychecks again. In case of reoccurrence of this issue, waste no time in calling the support team on +1.855.888.3080.

FAQs

Why am I getting QuickBooks error 2002 when trying to send payroll data?

The QuickBooks Payroll error code 2002 represents a server connection problem, which occurs due to an invalid security certificate, incorrect system date & time, firewall blocking QuickBooks, an invalid digital signature certificate, or internet connection issues.

How can I prevent QuickBooks Payroll error 2002 from happening again?

You can prevent QuickBooks Payroll error Code 2002 from happening again by ensuring your internet connection is stable, your system date and time are correct, your QB is up to date, your tax table is up to date, you’re using QuickBooks as an admin, and you have made exceptions for QBDT in the Firewall.

How to install a new security certificate to fix QuickBooks Payroll Connection Server Error 2002?

To install a new security certificate for fixing the QuickBooks Payroll error 2002, first, find the QBW32.exe file, right-click on it, and select Properties. Now, go to the Digital Signatures tab, and click on Details, followed by View Certificate. Finally just press Install Certificate.

More Payroll Related Articles :

What is QuickBooks Assisted payroll?

QuickBooks Desktop Payroll Not Working

How do I renew my QuickBooks payroll subscription?

QuickBooks internet connection error when sending payroll

How do i adjust my payroll liabilities in QuickBooks Desktop

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.