QuickBooks error 3120 interrupts the seamless processing and running of the application. Since users expect the smoothest services with this technology, knowing the reasons and troubleshooting methods for this issue becomes critical. Let’s dive into a comprehensive guide about error code 3120 in QuickBooks.

Error 3120 in QB is an annoying error code in the application, which is also known as the runtime error. The error typically occurs when you try to download payments from your bank account using the QuickBooks application. However, when you try it through an invoice, the error message does not appear on your screen. The error code depicts that a specific object is missing, or QuickBooks is unable to find it. There are several other reasons that can evoke error 3120 in QuickBooks. In this post, we will discuss the various aspects of QuickBooks error 3120 and troubleshoot it by applying some effective solutions.

“Has QuickBooks error 3120 targeted your QB Desktop and is causing significant issues in functioning? Reach out to Support at 1.855.888.3080 and talk to our experienced professionals to overcome the error effectively”

You may also see: Steps for Writing off Bad Debt in QuickBooks

Table of Contents

QuickBooks Error Message 3120: What Does It Mean?

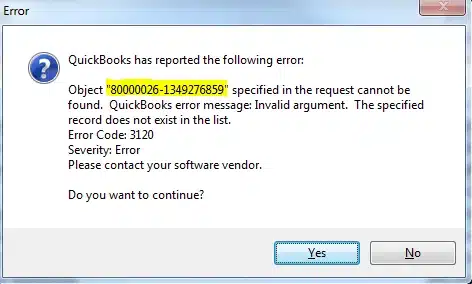

On the arrival of the QuickBooks Banking Error 3120, you can see different object names appearing on the screen, such as 800000-1349276859, 14A5D-1435238985, and many more. The error message states, “QuickBooks has reported the following error:

- Object: “800000-1349276859” specified in the request cannot be found.

- QuickBooks error message: Invalid argument. The specified record does not exist in the list.

When the error occurs, you may not be able to download payments from your bank in QuickBooks. However, you may continue using the application by clicking Yes. Trying to enter the transactions already entered may cause the issue to emerge. When the payment download crashes through a seemingly accurate invoice, QuickBooks Desktop Error 3120 may emerge.

Another instance when users may encounter this error is when the user fulfils the deal/ buy requests, a bill or receipt gets synchronized to QB from rapid inventory and later connected to the beginning of the exchange. When the beginning of the exchange gets erased or shut physically, QuickBooks error code 3120 may erupt. In the next section, we will see the possible causes behind the QuickBooks error 3120.

What Are the Primary Reasons for QuickBooks Error Code 3120?

QuickBooks error message 3120 can take place due to multi-pronged technical reasons. You can find them in the below-given steps:

- When you haven’t mapped the account appropriately, the error 3120 may appear.

- Corrupt download or damaged installation of the QuickBooks application can also cause QuickBooks transaction update error 3120.

- Discrepancies in the invoice when you compare it to the QuickBooks may trigger a 3120 error.

- Damaged data in the QuickBooks company can also trigger QB Error 3120 when downloading payments in QuickBooks.

- When you are asked to close the rapid inventory by adjusting it, it may lead to the 3120 issue in QB.

- If the initial exchange was removed or manually modified in the QuickBooks application, users may receive error 3120 in QB.

- Inaccurate settings of QuickBooks POS can cause error 3120.

- Inappropriate QB installation can cause an error.

- The error will appear as ####### in the receipt because the account is invalid or typed in the wrong way.

- Invalid reference to QuickBooks Receivables and Payables can cause the issue.

How to Troubleshoot QuickBooks Error Message: Invalid Argument?

QuickBooks error 3120 can prevent you from downloading your bank transactions in the software, and therefore, you need to resolve the error as soon as possible. Downloading transactions in QuickBooks can help you in tracking your business income and expenses so that you can get to know how your business is performing. It can also help you to make more informed decisions to boost your business profits.

Before beginning with the troubleshooting methods for error code 3120 in QuickBooks, pay attention to the following points:

- The payment made by the customer and the amount entered in the invoice must match.

- Further, the actual payment made by the customer and the amount entered in the invoice should also be the same in the receivables account.

- Also, run an invoice Query to see if the invoice with a particular taxation ID actually exists in the database.

- To resolve the error code 3120 in QuickBooks, follow the below-given steps with full care and attention:

You may also read: Steps to Change Direct Deposit Bank Account in QuickBooks

Solution 1:

- Launch the QuickBooks application in the first place and then go to the File menu.

- Now go to the Preferences and then click on Workstation and then further click on Account Preferences.

- Now move to the Basic and Advanced options and then confirm that all the accounts are mapped properly.

- Click on Save to proceed further.

- If an account is not mapped properly, it will be shown in the brackets.

- Now try to run the financial exchange again and then check if the Intuit error 3120 is resolved.

Solution 2:

- Use QuickBooks’ advanced search for the transaction value describing the error

- Either delete the transaction record that appears, modify the sync data that will disable the record from syncing with QuickBooks, or remove the transaction value and sync the records again.

- Once done, check if the error has vanished.

Solution 3:

- Verify the repayment as Uploaded in the Service Monster, so it doesn’t attempt to transfer with Web Connector.

- Validate the payment created in QuickBooks, and if not, do it manually in QB.

Other 3000-series errors and troubleshooting-

The 3000-series errors arise when QuickBooks Desktop Point of Sale and QuickBooks Desktop application encounter issues during the financial exchange. The various error messages with codes are as follows:

Note: Before troubleshooting QuickBooks 3000-series errors, it’s crucial to create backups for the QuickBooks Desktop POS file and QuickBooks POS file.

QuickBooks Error 3000

Receipts with service department items may produce error message 3000 when conducting an exchange from QuickBooks POS to QB receipts. The error codes may appear as follows:

- Employee Hours Status code: 3000; Status message: The given object ID in the field “list id”: is invalid

- Status code: 3000; Status message: The given object ID in the field “list id”: is invalid

The first code appears due to inactive employees or when the track data is not set up. The second code appears due to an outdated QuickBooks Financial patch. Therefore, the rectification methods include:

- Setting up track data time in QuickBooks Financial.

- Setting up inactive employees.

- For an outdated patch, the steps involve: Open QuickBooks > Go to Downloads and Updates > Find your QB version > Choose to Get Latest Updates.

QuickBooks Error 3100

When a customer or vendor is damaged or replicated from another QuickBooks Desktop or POS, the following error message will emerge:

Error Status code 3100: Status message: the name “#######” of the list element is already in use

In such a situation, users must first consider the following crucial points:

- Forming a backup of your company files before attempting to troubleshoot the error can prevent you from losing your essential files.

- You should switch from multi-user to single-user mode in QB Desktop.

The solutions you can apply to troubleshoot this error include:

- Searching for the duplicate names.

- Fixing the damaged customer or vendor names.

- Sorting the lists again.

QuickBooks Error 3140

The QuickBooks error 3140 may appear as follows when infecting the system:

- Status code 3140 or 3120: The specified account is invalid or of the wrong type

- Status code 3140: There is an invalid reference to QuickBooks AR/AP Account “###### – #########” in the Receipt or Bill

- Status code 3140: Status Message: There is an invalid reference to QuickBooks Account “###### – #########” in the item Non-Inventory. QuickBooks error message: The expense account is invalid

The reasons for these error messages popping up may be as follows:

- Incorrect accounts mapping.

- Accounts receivable and payable are not mapped properly to the accounts in the QuickBooks POS and indicate wrong settings.

- The mapped item account in the Point of Sale might be incorrect.

- Item account may be deleted or inactive in QB Financial.

The following solutions can help rectify QuickBooks error 3140:

For Status code 3140 or 3120: Specified account invalid or wrong type:

- Launch QB Desktop POS and choose the File Menu.

- Navigate and select Preferences > Company.

- Under the Financial section, hit the option indicating Accounts.

- Verify the Basic and Advanced tabs. Ensure to map the accounts correctly and hit Save. (If the account name is in brackets, it means it hasn’t been saved.)

- Now, operate the Financial Exchange.

Status code 3140: Invalid reference to QB AR/AP accounts in bill or receipt

- Open QuickBooks Desktop POS.

- Follow the path File > Preferences > Company > Accounts (under the Financial section)

- Save and conduct the Financial Exchange.

For Status Code 3140: Invalid reference to QB account in the non-inventory item

- Launch QuickBooks Financials.

- Go to the Lists menu, and choose the Chart of Accounts.

- Hit the Accounts option at the bottom and choose Show Inactive Accounts (inactive accounts have an X beside their name).

- Hit the X mark and right-click the account.

- Next, select the Make Account Active option.

- Now, conduct another financial exchange.

QuickBooks Error 3412

QB error 3412 emerges on the screen when QB Desktop has a preference set inside stating not to sell to overdue customers. The error message states:

Status code: 3412, Status message: Customer has an overdue transaction

Resolve this problem in QuickBooks Desktop as follows:

- When you open the QB Desktop, move over to the Edit menu and choose the Preferences option.

- At the left menu, select the Sales and Customers option.

- Hit the Company Preferences tab and follow it by unchecking the “Do not sell to overdue customers” box.

- Hit OK to implement the changes, go to QB POS and operate the financial exchange.

QuickBooks Error 3170

A duplicate name between QuickBooks Point of Sale and QuickBooks Desktop can lead to QuickBooks Error 3170 as follows:

Status code 3170: There was an error when trying to modify a vendor/customer list element.

Steps to follow to troubleshoot this problem are as follows:

- Go and verify the activity log in the QuickBooks Desktop Point of Sale.

- In the QuickBooks Desktop, alter or verify the name of the customer or vendor.

- Now, merge the edited names and look for the presence of the error.

Need Further Technical Assistance?

The steps discussed in this post can help you troubleshoot the QuickBooks transaction update error 3120. However, if you are not getting the desired results after performing the steps, dial Proadvisor solutions Support Number 1.855.888.3080. It will connect with one of our qualified experts, with whom you can describe the symptoms of the error you are experiencing. Based on your error description, you will get relevant assistance in troubleshooting QuickBooks error 3120.

FAQs

How will I know if error 3120 is affecting the system?

Error 3120 in QuickBooks occurs when record planning is faulty. Set up QB’s work location correctly to fight the issues effectively. When the error 3120 appears, users may face issues like crashing or freezing operating systems, programs, etc. The blue loading circle may keep spinning, and the error might not yield adequate results. Further, the receipt might have ##### instead of actual values.

What is the status code of error 3120 QB?

The QB status code 3120 is as follows:

“Error

QuickBooks has reported the following error:

Object: “800000-1349276859” specified in the request cannot be found. QuickBooks error message: Invalid argument. The specified record does not exist in the list.

Error Code: 3120

Severity: Error

Please contact your software vendor.”

Will error 3120 QB harm my business data?

No, QuickBooks error 3120 won’t harm your business data. However, it’s crucial to make a backup of your company files beforehand to prevent any data loss.

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.