Payroll is a QuickBooks-integrated service offered by Intuit, which makes your accounting processes easier by automating functions such as running payroll, calculating and paying taxes, e-filing, and keeping track of all your liabilities. However, there can be a time when you might have to adjust payroll liabilities in QuickBooks. Therefore, it is essential to know the steps to do the same. That’s exactly what we’re gonna explain in this blog. So let’s get started.

Need assistance with adjusting your payroll liabilities in QuickBooks? Contact our Proadvisor Solutions’ professionals at 1-855-888-3080 today!

Table of Contents

What are Payroll Liabilities in QuickBooks? A Short Explanation

As a business, payroll liabilities are the amounts of money you owe in the form of wages, salaries, unpaid taxes, expenses, and other payments. It also includes tax deductions from the employee’s salary and other benefits or deductions the person is subject to, making it an important section in QuickBooks Payroll.

Some Cases Where You Might Have to Adjust Payroll Liabilities in QuickBooks

Some of the cases where you might have to adjust payroll liabilities in QuickBooks are mentioned below:

- You might have set up the wrong tax tracking type for an item like the Health Insurance Company Contribution

- You might need to change or modify the item amounts linked to the company contribution

- To edit the wage of an employee if you have deducted or added YTD wages

These were examples of some cases where you may need to adjust the liabilities for your company.

Steps to Perform Before Adjusting Payroll Liabilities in QuickBooks

If you’re looking to adjust payroll liabilities in your QB workstation, here are some of the steps you need to perform before doing the same:

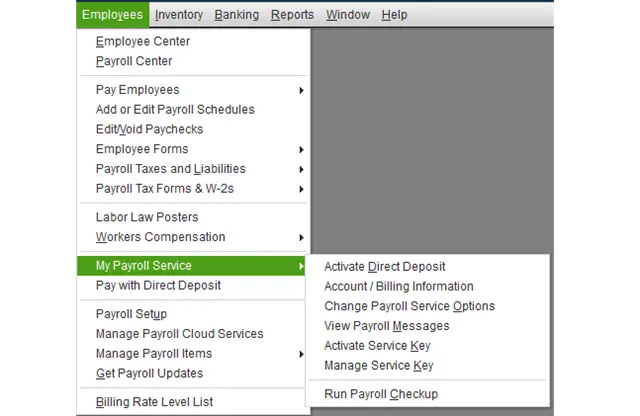

- Open the QBDT app

- Navigate to the Employees menu

- Press My Payroll Service

- Then, select Run Payroll Checkup

- Click on Continue

- Follow the instructions on your screen

- The tool will offer you some suggestions

- Review the current setup and look for any missing information and discrepancies

- Verify employee records, tax amounts, wage amounts, and payroll item setup in order to determine any flat-rate tax problems

These were some steps you should execute prior to adjusting payroll liabilities in QuickBooks.

How to Adjust Payroll Liabilities in QuickBooks Desktop?

To make different types of adjustments to payroll liabilities in QuickBooks, you can follow the methods given to you down below.

Steps to Adjust the Payroll Liabilities in QuickBooks Desktop

Given below are the steps you can implement to adjust payroll liabilities in QuickBooks Desktop

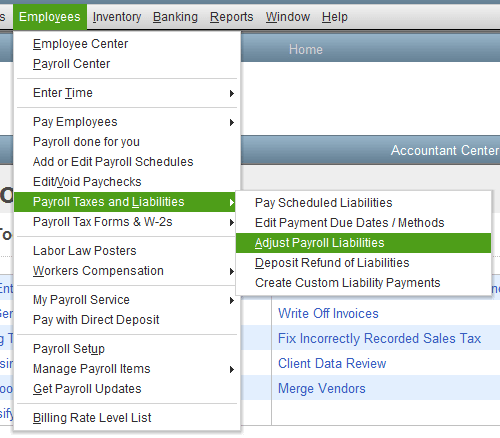

- Run the QB Desktop app

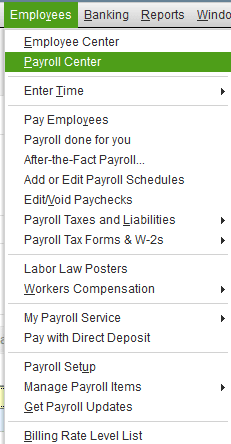

- Go to the Employees menu

- Choose Payroll Taxes and Liabilities

- Select Adjust Payroll Liabilities

- Go to the Effective Date field

- Choose the quarter for which you want to adjust the liabilities

- Select Employee Adjustment if the company pays the item. This affects the YTD info on the W-2 form

- Select Company Adjustment if the balance needs to be removed from the PLB report

- Choose the Employee

- Fill in the required information in the Taxes and Liabilities fields

- Select the Item Name that needs to be edited, and choose the Amount of adjustment

- Positive number to increase the amount

- Negative number to decrease the amount

- Fill in the Wage Base

- Go to the Memo field

- Type a note in order to remember the reasons for adjustment in the future

- Select the Item Name that needs to be edited, and choose the Amount of adjustment

- Hit Accounts Affected

- Press OK

- Repeat the steps for each employee

- Rerun the Payroll Summary Report for verifying the adjustments

Now, let’s look at adjusting liabilities for already paid taxes in QB.

Adjusting Payroll Liabilities for Already Paid Taxes

To adjust payroll liabilities in QuickBooks for the taxes that are already paid, follow the steps given below:

- Open QB Desktop

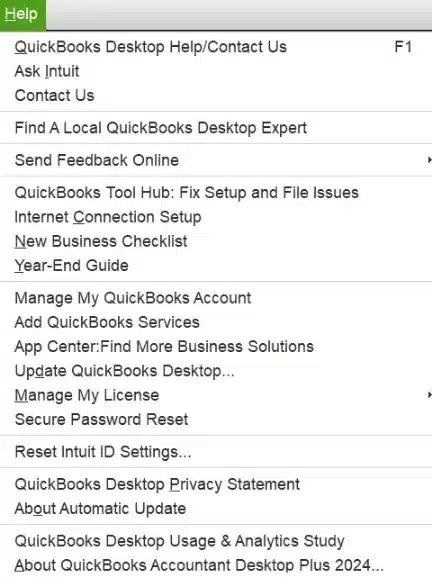

- Navigate to the Help menu

- Select About QuickBooks

- Press Ctrl + Alt + Y

- Or Ctrl + Shift + Y

- This will open the Setup YTD Amounts window

- Click Next until you arrive at the Enter Prior Payments option

- Choose Create Payment

- Enter all the prior paid payroll liabilities

- Enter the Payment Date

- Enter For Period Ending Date

- Go to the Taxes and Liabilities field

- Select the payroll tax item you’ve already paid

- Enter the amount

- Press the Accounts Affected… option

- Choose between these three options:

- Do not affect accounts: Only use this option if your QB accounts have correct balances. This would make the payment not show up in your bank register at all

- Affect liability accounts but not the bank account: Make use of this option if your checking account has the accurate balance. The payment won’t show up in your bank register

- Affect liability and bank accounts: Select this if both of the account balances are incorrect. The payment will show up in your bank register

- Click OK

- Repeat the steps for every payment

- Click on Done to save your work

- Finally, hit Finish to exit the window

This was it about adjusting payroll liabilities for already paid taxes in QuickBooks.

Method to Correct a Payroll Liability Check

Given below are the steps you need to execute for correcting a payroll liability check in QuickBooks:

- Open QuickBooks

- Browse to the Banking menu

- Select Use Register

- Then, choose the register you use for payroll

- Click on OK

- Right-click on the Liability Check

- Select Edit Liability Check

- Make changes accordingly

- Press Save & Close

This would help you correct a payroll liability check in QuickBooks Desktop.

Adjusting the Payroll Liability Item if Posted on the Wrong Chart of Accounts

To adjust the payroll liabilities item posted on the wrong account in the Chart of Accounts, follow the steps given below:

- Open the QBDT app

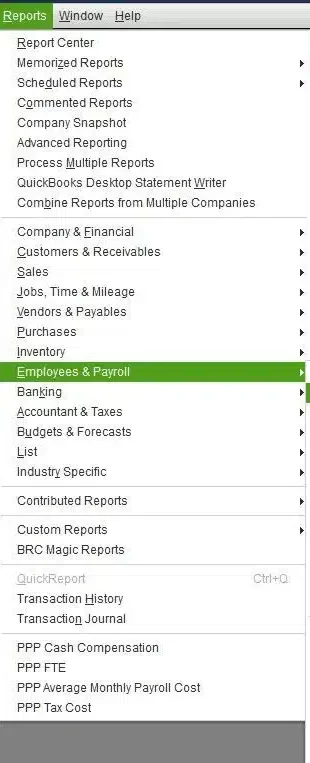

- Browse to the Reports menu

- Select Employees and Payroll

- Choose Payroll Item Listing

- Check the Expense and Liability Account columns

- Look for the incorrect account

- Double-click on it to open or edit it

- Click Next

- Make the necessary changes

- Keep clicking Next

- Press Finish

Now, let’s look at the procedure to delete payroll liability in QuickBooks Desktop.

The Right Way to Delete Payroll Liabilities in QuickBooks Desktop

Follow the steps given below to delete the payroll liabilities in QuickBooks Desktop:

- Access the QBDT app

- Go to the Employees menu

- Click on Payroll Center

- Move to the Pay Liabilities tab

- Press Adjust Payroll Liabilities

- Press the Previous button until you find the liability you want to delete

- Select the liability

- Click on Edit

- Press Delete Payroll

- Confirm to delete

Looking to clear payroll liabilities? Read the following method

Steps to Clear Payroll Liabilities in QuickBooks Desktop

To clear any payroll liability that you don’t need or has already been paid, follow these steps:

- Open the Employees menu and go to the Payroll Center

- Browse to the Pay Liabilities tab

- Choose the liabilities you wish to clear

- If the payment has been made already, select Mark as Paid

- Go to the Adjust Payroll Liabilities section if you wish to zero out the balances

This section covered the details about adjusting payroll liabilities in QuickBooks Desktop. Now, let’s proceed to adjust the same in QB Online.

How to Adjust Payroll Liabilities in QuickBooks Online?

The option to adjust payroll liabilities in QuickBooks Online is not available yet. However, you can make certain adjustments with the following steps:

- Click on the Gear icon in QBO

- Go to Payroll Settings

- Select Liability Settings

- Click on Tax Setup

- Select the item you wish to adjust

- Update the amount (if needed)

- Update the date (if needed)

If you need further assistance with adjusting payroll liabilities in QuickBooks Online, you can contact our Proadvisor Solutions’ expert team.

Conclusion

In this blog, we discussed about the way to adjust payroll liabilities in QuickBooks. We also talked about the potential reasons you need to make a liability adjustment and the steps you need to perform before adjusting the same. Moreover, we provided you with a step-by-step guide you can follow to make adjustments in both QB Desktop and Online. If you want any further assistance for the same, don’t hesitate to contact our QB professional team today at 1-855-888-3080.

FAQs

How to adjust payroll tax liabilities in QuickBooks Online?

The feature to adjust tax liabilities in QB Online Payroll is not yet available. We recommend contacting our payroll experts, who can review your account and make the needed adjustments.

How can I make journal entries for payroll liabilities?

To make journal entries for payroll liabilities in QBDT, you have to first record the total gross wages in the salary expense journal and then credit the other payroll liabilities.

How to record a payroll tax liability payment in QuickBooks Online?

To record a tax liability payment in QBO, open the Payments tab and then go to the Upcoming tax payments section. Press Pay for the tax you wish to pay and select the Payment Date. Type the check number, and choose Record and print.

More Useful Articles :

QuickBooks Payroll Not Working : Experts’ Solutions

Solved: QuickBooks Payroll Not Updating In QB Desktop

Resolved: QuickBooks Payroll is Not Taking Out Taxes

How to Fix QuickBooks Drop Down Menus Not Working

Fix QuickBooks Keeps Crashing or QB Shutting Down Error

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.