Users with an active QuickBooks Payroll Subscription save a lot of time and effort calculating taxes for their business and employees. Users have raved about this feature of the application, but at times, for several reasons, it may occur that QuickBooks payroll is not taking out taxes.

Are you experiencing something similar, then you must not look further since our experts have listed ways to deal with a situation like this.

When you see that QuickBooks payroll is not taking out taxes, follow the solutions listed in this blog, or for an efficient way out, we suggest calling the Proadvisor solutions’ Payroll support team on +1.855.888.3080.

Table of Contents

Why the QuickBooks payroll is not taking out taxes?

For various reasons, your payroll taxes aren’t calculated in QuickBooks. We will list them down for you in this section. Study these reasons before jumping to the solutions when QuickBooks payroll is not taking out taxes.

- If the complete annual salary surpasses the salary limit, you may see that QuickBooks payroll is not taking out taxes.

- The value of the total wages of the employee’s prior payroll is too low.

- You have not updated the payroll tax table to the latest version.

Follow this short article if you want to fix QuickBooks Error 6190

What can you do when QuickBooks Desktop calculates payroll taxes incorrectly?

We will now look at various methods that our experts have found when QuickBooks Desktop calculates payroll taxes incorrectly, or QuickBooks payroll is not taking out taxes at all.

Method 1: Update the tax table in QuickBooks Desktop to the latest version

Before updating the tax table, it is recommended you should have an active QuickBooks Desktop Payroll subscription. Additionally, we suggest updating your tax table whenever you have to pay the employees.

You can review the status of your tax table from the QuickBooks Desktop company file. Use the steps below:

- Click on Employees and then choose Get Payroll Updates.

- Press the Payroll Update Info button and see the update based on the table below.

| Payroll Update Number | Date Released |

| 22210 | 4/28/22 |

| 22209 | 4/7/22 |

| 22208 | 3/24/22 |

| 22206 | 2/17/22 |

| 22204 | 1/27/22 |

If the tax table is not updated, then follow the instructions:

- Go to Employees and then choose Get Payroll Updates.

- Checkmark the Download Entire Update checkbox by selecting it.

- Click on Download Latest Update. Once the download is complete, a window will appear depicting the same.

Method 2: Manually Update QuickBooks Desktop to fix QuickBooks Payroll is not taking out Taxes issue

An outdated QuickBooks application can sometimes lead to various errors, so we suggest updating the application to fix these glitches.

- If open, close the QuickBooks app and the company file.

- Navigate to the Start menu on your desktop.

- Look for the QuickBooks application.

- Once you find it, right-click the icon and choose Run as administrator from the drop menu.

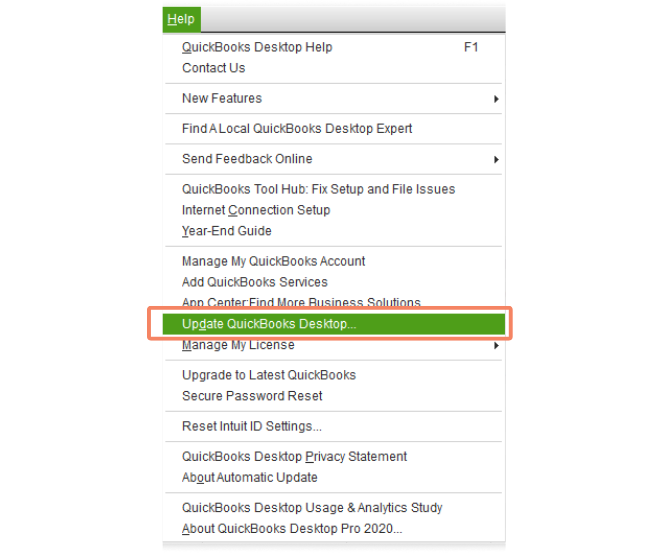

- No Company Open window will launch. Navigate to the Help menu and choose Update QuickBooks Desktop.

- Click on the Options tab and select the Mark All option.

- Hit on the Save button.

- Click on the Update Now tab and choose the Reset Update checkbox.

- Once all is set, press Get Updates.

The update process will start and once it is complete, reopen QuickBooks Desktop after closing it. Press the Yes button and after the installation, restart your system.

Method 3: Revert the paycheck of the employee to fix QuickBooks Payroll is not taking out Taxes error

You may ask why this solution works when QuickBooks payroll is not taking out taxes. Then, we must tell you that you refresh the payroll data by going through these instructions to calculate the taxes effectively.

- First, go to your employee’s Payroll Information.

- On your employee’s name that is highlighted in yellow, right-click.

- At last, click on Revert Paycheck.

Method 4: Review if the deduction payroll item is set to calculate based on Net or Gross

The calculation can change based on Net or Gross, and you can see how the item is calculated using the following steps:

- From the top of the menu, click on Lists and then choose Payroll Item List.

- You must right-click on the deduction to review and click on Edit Payroll Item.

- Keep pressing the Next option until you land on the Gross vs. Net screen.

- See if you have made the proper selection.

- Hit on the Next button until you find the Finish option.

- Finally, press Finish.

Follow this short guide if you ever face the QuickBooks Error 40001

Method 5: Review the annual limit for the employee

As discussed in the reasons why QuickBooks payroll is not taking out taxes, surpassing the annual limit was one of them. By following the steps in this method, you can review if the This is an annual limit checkbox is selected, and the limit set as default has been achieved for the employee. In such a case, QuickBooks must have calculated the payroll item accurately in the past, and now, QuickBooks payroll is not taking out taxes.

Complete the review process of the same with the following steps:

- From the menu bar at the top, click on Lists.

- Choose Payroll Item List.

- Use right-click on the payroll item to open a menu.

- From the menu, select Edit Payroll Item.

- Keep pressing the Next button to reach the Limit Type screen.

- Review the limit that is available in the bottom box. See if it is accurate.

- When it is the correct limit, the payroll item of the employee will stop calculating at this point.

- Else, update the amount.

- Use the Limit Type option to see if the right option is picked.

- Annual – Restart each year

- Monthly – Restart each month

- One-time limit

- Adjust the default limit and/or Limit Type selection as per your need.

- Hit on the Finish button.

Winding up the guide…!

Various methods to employ when QuickBooks payroll is not taking out taxes have been discussed in detail using this blog. The blog aims to eliminate payroll errors so that your company’s reputation is maintained in front of your employees. But, if the above steps were overwhelming or proved futile, try reaching the Proadvisor solutions payroll support team on +1.855.888.3080.

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.