If you are a regular QB user, you know how important the payroll function is in performing many essential tasks. Whether it be processing the employee payroll or calculating the tax withholdings, you need the QB payroll service to make your business operations easier. This means that to reap these benefits and features, Intuit expects the user of the payroll service to put an active subscription into use. If your payroll subscription isn’t active or is up for renewal, then follow the different methods and steps provided in this guide to renew QuickBooks payroll subscription with ease.

Renewing your QB payroll service is an easy process that you can undertake with basic instructions. However, if you are short on time or don’t want to activate the subscription on your own, our Proadvisor solutions’ team of experts at 1.855.888.3080 will provide you prompt assistance with the payroll service.

Table of Contents

Main Reasons Why You Must Activate Your QB Payroll Service

Just like the QBDT program subscription, you must get a payroll service subscription to enjoy many essential features, which are mentioned in the list below –

- QuickBooks payroll automatically calculates federal, state, and local taxes, including deductions and tax withholdings, based on ongoing laws and regulations.

- One useful feature of the QBDT payroll service is the fact that all paystubs and W-2s are available online through a secure website for employees.

- With an active payroll service, users can enable direct deposit to securely send employee paychecks directly to their bank accounts.

- QB payroll subscribers can seamlessly and promptly file payroll taxes electronically to the IRS and state agencies.

- A valid payroll subscription allows you to connect time-tracking tools to generate payroll automatically based on employee hours worked.

- QB payroll users can stay updated with changing payroll regulations and avoid potential penalties, thus saving time and money.

- Finally, if a business has an active payroll subscription, QB allows it to generate specific payroll reports for the business to assess recent trends and labour costs.

Therefore, the payroll option is a big component of QuickBooks, and subscribing to it can provide numerous opportunities.

Various Methods to Reactivate QuickBooks Desktop Payroll Subscription

To learn how to reactivate QuickBooks payroll subscription, you must know the various methods. There are several walkways to reactivate QuickBooks Desktop payroll subscription, which include the following –

- Official Intuit website.

- Via your QB Company file.

- Using a cancellation email.

Method 1: Official Intuit Website

The first method to directly renew QuickBooks Payroll Subscription is from Intuit’s official website. This subscription-reactivation method is quite easy to implement by using the detailed instructions below –

- The initial step requires you to sign in to Intuit using your login credentials, and once signed in, you must move to the Manage your QuickBooks page.

- Head to the Product or Services section, then move forward to choose the Payroll Subscription available below Products & Services and go to the Service Information section.

- Now, click on the Reactivate link provided in the Service Information section and review your Payroll service details before proceeding.

- After reviewing, click Proceed, choose a suitable payment mode at your convenience, and move forward to make the payment.

- Provide your CVV Number, enter it, click the Submit button, and choose the Continue option.

- Once you place the order, click Next, and you will encounter a pop-up message on the screen that indicates that your QBDT payroll subscription has been reactivated.

After the process ends, rerun QuickBooks and check the payroll function to ensure the QuickBooks payroll subscription renewal is done correctly.

Method 2: Through the Company file

Another alternative to reactivate QuickBooks payroll subscription is to go through the company file using the thorough steps mentioned below –

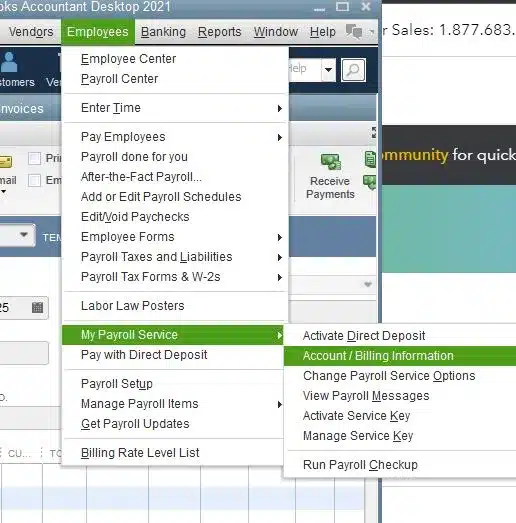

- Initially, head to your QuickBooks desktop Company file, then move to the Employees tab and opt for the My Payroll Service option.

- Open the drop-down menu, and from the option available in the list, proceed to the Account/Billing Information and sign in to your Intuit account.

- Once you confirm your credentials, your QuickBooks Account page will open, then move to the Service Information screen and click on the Reactivate link.

- Further, choose your Payroll service, click Proceed, and choose the preferred Payment method to continue.

- Now, select Submit to proceed ahead, go to Place Order, tap on it, and click Next to proceed.

- Finally, follow the on-page instructions to conclude the reactivation process, then rerun QuickBooks to access the payroll service.

Method 3: From a Cancelation Email

Another method for QuickBooks Desktop payroll subscription renewal is directly from the cancellation email, as mentioned below –

- Open your email related to the subscription cancellation, opt for the Re-subscribe option, and move to the Intuit QuickBooks My Account page.

- Use your Intuit Login credentials to log in as a user, update the necessary payment information, and click Save and Continue to proceed ahead with the reactivation process.

- In addition, ensure that all the information you entered is correct, then click on the Reactivate link and wait for the success message ‘Your Subscription has been Reactivated.’

It may take up to 24 hours to complete the reactivation process, and once done, rerun QuickBooks and access the payroll function again.

Steps to Resolve Payroll Subscription Reactivation Error in QuickBooks

Although the above steps will help you reactivate the payroll service with ease, errors might sometimes arise in the process. If you are unable to renew QuickBooks payroll subscription, follow the troubleshooting solutions below to eliminate the issue –

Solution 1 – Update QuickBooks & the Tax Tables

If your QuickBooks payroll subscription doesn’t reactivate, chances are that either the program or the tax tables are outdated. To fix this problem, you must start by updating QB Desktop to the latest version and then proceed to update the tax tables using the instructions provided below –

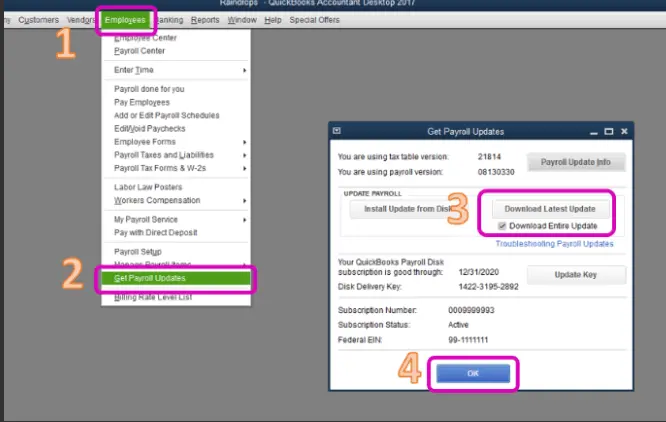

- Open the QuickBooks Desktop homepage, move to the Employees section, and click the Get Payroll Updates option to proceed.

- If you find available updates, select the Download Entire Update option, click Update, and wait for the informational window to confirm the update’s success.

Once the program and tax tables are updated, rerun the payroll function to ensure the subscription issues are eliminated.

Solution 2 – Revalidate the Payroll Service Key

If your payroll subscription displays as active but the service is not working, you must check the service key using the detailed steps below –

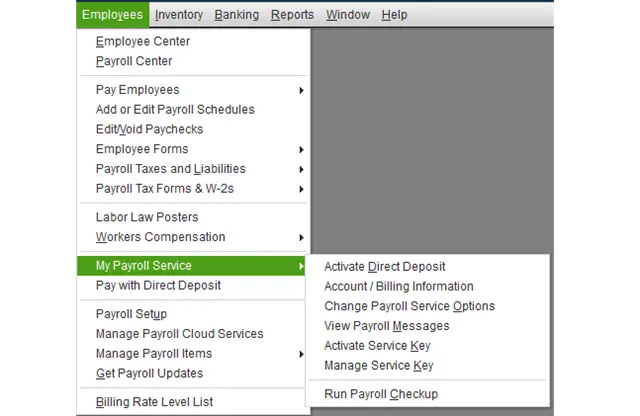

- Go to the Employees section in QB, then select My Payroll Service and click the Manage Service Key option.

- Now. move to the QuickBooks Service Keys window, click Edit at the bottom, take note of the service key, and select Add.

- Enter the service key you’ve noted in the service key field, select Next and Finish, and wait for the Payroll Update message to appear.

- Finally, select OK, verify that the Service Status shows as Active, and click OK again.

Now, review the payroll subscription and rerun the functions to ensure the QuickBooks subscription issue is resolved.

Solution 3 – Delete the Paysub.ini Files from the PC

Sometimes, users might try to activate their subscription after updating or installing a new QB version but fail. In such a scenario, the best solution is to find and delete the paysub.ini files before reactivating the payroll service as follows –

- Open the ‘display hidden files or folders’ section in your Windows OS, enable the option, then move to the Search field and type Paysub.ini.

- Once you see the Paysub.ini file, right-click on it, select Delete, and repeat the same steps until all Paysub.ini files are deleted.

After the process ends, rerun QuickBooks and check your payroll subscription to ensure it is successfully reactivated.

The easy solutions and steps mentioned in this detailed blog will help you renew QuickBooks payroll subscription and tackle any errors along the way. However, if you aren’t able to reactivate QuickBooks even after following these steps, you must seek assistance from our specialists at 1.855.888.3080 to get immediate help with the payroll subscription issue.

Read More Related Articles :

Solutions for Eliminating the QuickBooks Error 15311

QuickBooks Payroll Not Updating? Let’s Fix it

How to Fix QuickBooks Error PS038 (when paychecks get stuck)

QuickBooks Error PS036: Cannot verify the payroll subscription

Common User Questions

What are the correct steps to check the payroll subscription status in QB Desktop?

After reactivating your QB payroll service, you can review or verify the subscription status by using the detailed steps below –

– Open the Employees menu in QBDT, head to the Payroll Service section, and open the Account/Billing Information tab.

– In the tab, look for the Service Status to ensure it displays as Active and exit the process.

Are there any other reasons why I am unable to reactivate my QBDT payroll service?

Apart from the reasons mentioned above, you might face network issues while activating payroll. The subscription error can also occur due to software conflicts (like your anti-virus app or Windows firewall). Thus, you must ensure a strong and reliable network and that the anti-virus or firewall isn’t creating blockages before activating the payroll service.

Is it possible to renew QuickBooks payroll subscription even after missing the renewal deadline?

If you did not manage to subscribe to the payroll service within the required time of the subscription, you can renew your subscription later, though you might be charged extra fees for renewing the subscription.

What happens when the payroll service subscription expires in the QuickBooks application?

If your payroll subscription status has expired or become inactive, you won’t be able to perform essential payroll tasks, like tax calculation, direct deposits, etc. You will also get recurring pop-up messages that remind you of the expired subscription, which can make running the software program difficult.

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.