When you run a business, you’re subject to many payroll liabilities, such as employee compensation, taxes, expenses, and other payroll-related costs. But you might encounter that your QuickBooks Payroll liabilities are not showing up in your Payroll Center. This can stop you from fulfilling obligations such as taxes and other business-related expenses. Additionally, it also hampers you from generating an accurate financial report and auditing your data, which won’t justify the current financial health of your business. However, this issue can be easily resolved with the help of our guided solutions given in this blog. So without further ado, let’s move on ahead to the next section.

Are your QuickBooks Payroll liabilities not showing up? Contact our ProAdvisor Solutions experts at 1-855-888-3080 today to resolve this issue.

Table of Contents

QuickBooks Payroll Liabilities are Not Showing Up? – These are the Reasons

Some of the key factors that can result in QuickBooks Payroll liabilities not showing are mentioned below:

- Wrongly mapped payroll items within various liabilities accounts won’t allow you to access payroll liabilities

- The account used to see your payroll liabilities might be inactive and was removed from the QB Payroll processing system

- The date range in your payroll liabilities can be wrong, preventing you from seeing properly categorized liability checks

- You’re using an outdated version of QuickBooks Desktop

- You’re using an outdated version of QB Payroll and Payroll Tax Table, leading to this problem

- Incorrect categorization of the QB Payroll list can cause the liabilities to not show up

- Your Windows Firewall and other AV software can be obstructing QB from functioning properly

- You might have not assigned a payroll schedule for a newly added payroll item

These were some of the reasons your QuickBooks Payroll liabilities are not showing up. Now, let’s proceed to troubleshoot this problem in the next section.

QuickBooks Payroll Liabilities Not Showing: Methods to Fix

Now, in the section below, we are going to mention many proven methods you can implement to fix the QuickBooks Payroll liabilities won’t show up problem.

Update Your QuickBooks Desktop to the Latest Version

This may sound simple, but an outdated QB software can give rise to many program-related problems and can ultimately be the reason you’re unable to see payroll liabilities. To resolve this issue, update your QB Desktop to the latest version. If this doesn’t fix your issue, you can move on to the next solution.

Try Activating Your Payroll Liability Account

The reason your payroll liabilities are not showing up in QuickBooks can be because your payroll liability account is inactive. To resolve this, follow the steps given below:

- Open the QB Desktop application

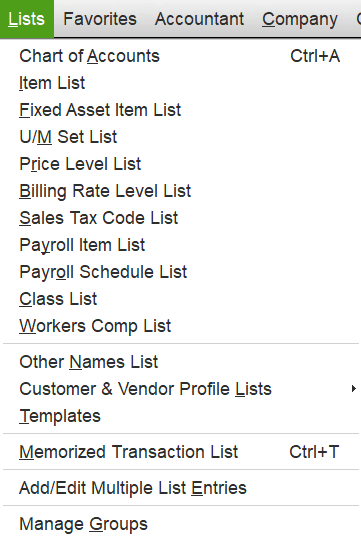

- Navigate to the Lists menu

- Click on Chart of Accounts

- Now, find the names of relevant accounts, such as federal income tax and insurance contribution tax

- Check if the liability account is displayed as Inactive

- If so, click on Edit

- Now, select Make Account Active

- Finally, press Save

If the problem was occurring due to an inactive payroll liability account, this would solve the issue.

Check and Modify the Date of Your Payroll Liability Checks

You might encounter the QuickBooks Payroll liabilities not showing issue due to the incorrect date range of your liability checks. Follow the steps below to patch this:

- Run the QBDT app

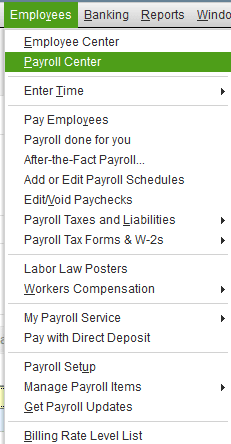

- Head to the Employees menu

- Then, select Payroll Center

- Click on the Transaction tab

- Now, press Liability Checks

- Select Date

- From the dropdown menu, find This Calendar Year

- Check the Paid Through Date

- Click on Edit if the date needs modification

- Enter the correct date

- Lastly, hit Save to apply the changes

Still dealing with QuickBooks Payroll liabilities not showing in the Payroll Center? Check out the following solution.

Schedule the Frequency of Your Payments

You might be contending with this error because you have not scheduled the payment frequency for your payroll taxes. You can do so with these steps:

- Access your QBDT software

- Go to the Employees menu

- Click on Payroll Center

- Then, press Manage Payment Methods

- Now, select Benefits & Other Payments

- Find Schedule Payments in Tax Payments

- Select Payroll Liability

- Then, press Edit

- Now, specify a frequency according to your comfort in the Payment (deposit) frequency section

- Finally, press Finish to close the window

This was it about scheduling the frequency of your payments. Move ahead to the solution given below if the error isn’t fixed.

Download the Latest Payroll Tax Table Updates

If you’re using an outdated tax table in QuickBooks, it can result in your payroll liabilities not showing up. Therefore, it’s essential to download the latest tax table updates in order to avoid this problem. It’s also recommended to download these updates to comply with the latest IRS and Tax Agency rules.

Map Your Payroll Items the Correct Way

Incorrectly mapped payroll items can result in QuickBooks Payroll liabilities not showing. Hence, it is recommended to map your items the right way with the following steps:

- Run your QBDT application

- Navigate to the Lists menu

- Now, press the Payroll Item Lists tab

- Then, choose a payroll item from the same list

- Right-click on the payroll item

- Select Edit Payroll Item

- Now, click on Next

- Choose Accounts

- Modify the payroll liability account if needed

- Then, verify if the mapping of the payroll items is correct

- If not, make the necessary changes

- Lastly, press Finish to save

Performing these steps would help eliminate the Payroll liabilities not showing up QuickBooks Desktop problem.

Configure Windows Firewall for QB Desktop

If your Windows Firewall is blocking your workstation, it will not be able to perform necessary tasks, ultimately leading to QuickBooks Payroll liabilities not showing up. This is why it is recommended to configure your Firewall to unblock QuickBooks. It would help eradicate this problem and many other issues arising when QB cannot communicate with the server.

Verify and Rebuild the QB Data File

A damaged data file can be the reason behind the QuickBooks Desktop Payroll liabilities not showing up. If that is the case, then you might have to verify and rebuild your QuickBooks data. But always remember to create a backup date file before you proceed with the solution. Doing this would eliminate the issue of payroll liabilities not showing in QuickBooks Desktop.

Check and Verify the Payment Info and Solutions You Received from the Agency

Follow the steps given below to check and resolve uncleared payments with a reason code sent by the agency:

- Open QBDT

- Click on the Employees menu

- Then, click on Payroll Center

- Now, browse to the Payroll Liabilities tab

- Navigate to the Payment History section

- Then, locate E-Payments

- To refresh the list, switch between the All Payments tab and the E-Payments tab

- Check the Status column

- If it is labelled as Agency Rejected, then it means the agency has rejected your payment with a reason code

- Click on the Agency Rejected link

- Select the E-Payment Rejected window

- Verify the payment information

- Check the problems sent by the agency

- Check the solutions

- Lastly, click on Void Rejected E-Payments

This would help fix the QuickBooks Payroll liabilities not showing issue.

Set Up a Payment Schedule for the New Payroll Employee

If you have added a new employee to your employees list and have not assigned a payment schedule for them, it can lead to some QuickBooks Payroll liabilities not showing up. To add a payment schedule for them, follow the steps given below:

- Double-click on the QBDT icon to open the software

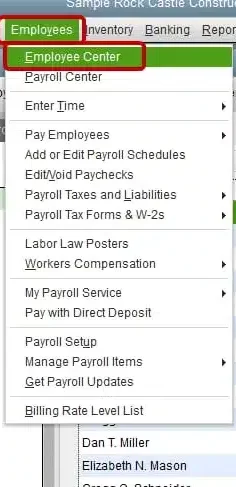

- Navigate to the Employees menu

- Select Employee Center

- Double-tap the employee’s name

- Select Payroll Info

- Click on the Payroll Schedule dropdown menu

- Now, choose the Payroll Schedule you want to assign to the employee

- Finally, hit OK

Implement the steps above to set up a payment schedule for a new employee.

Change the Payroll Liabilities

You can resolve the payroll liability not showing in QuickBooks issue by making certain liability adjustments with these steps:

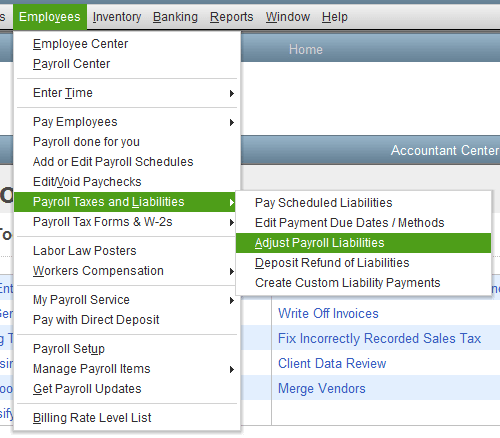

- In QBDT, click on the Employees menu

- Then, press Payroll Taxes and Liabilities

- Now, click on Adjust Payroll Liabilities

- Feed in the necessary details

- Now, choose the employee

- Enter details in the Taxes and Liabilities section

- Select Accounts Affected, followed by OK

If you’re still facing the same problem, you can check out the next solution.

Delete Your Tax Liability Payment Records

To mend the issue of QuickBooks Payroll liabilities not showing up, you can try to delete your past recorded data to see if it works. Make sure to back up your entire payroll data before you implement these steps:

- Open the QBDT software

- Browse to the Lists menu

- Then, click on Chart of Accounts

- In the Chart of Accounts window, select the account used for paying liabilities

- Locate the transaction

- Select it

- Now, press Delete Bill/Pmt-Check or Delete Check

- Then, navigate to the Payroll Liability tab to clear tax payments

- Choose Accounts Affected

- Press Do not affect accounts

After completing these steps, you won’t have to deal with the issue any longer.

Try Updating Your QB Company File

If you have just recently switched to a newer version(year) of QuickBooks Desktop, it’s important to update your company file to avoid problems like the QuickBooks Payroll liabilities not showing. Follow the steps below to do so:

- Sign out all users from your company file

- Open the new version of QBDT

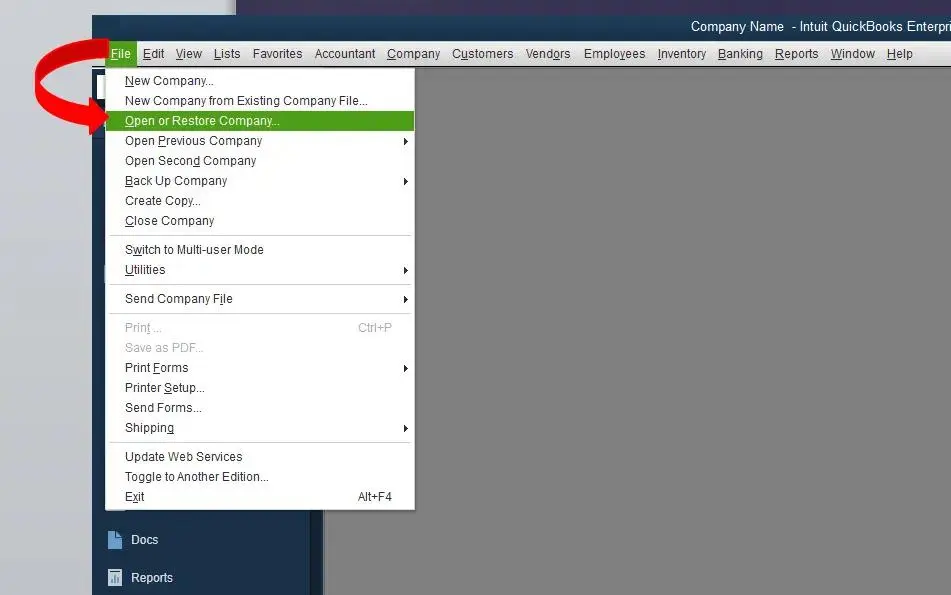

- Navigate to the File menu

- Click on Open or Restore Company

- Press Open a company file

- Click on Next

- Locate your company file and select it

- Hit Open

- Now, sign in to your file as an admin

- Press Update Now

- Once it’s finished, hit Done

This would help you rectify this error and other related problems.

Check the QuickBooks Payroll Liability Report

Check your payroll liability report to verify if you have unpaid liabilities in your company with the following steps:

- Open the Reports menu

- Navigate to Employees & Payroll

- Then, update the report date to match your schedule

- To see if you have a pending liability check:

- A liability balance is presented as Positive numbers (highlighted)

- An overpayment is shown as Negative numbers (underlined red)

- Paid liabilities are marked as Zero (underlined blue)

- Double-click on the liability amount

- Check the liability history and payment details

- If you see any Overlapping Liability Payment, correct the date

Still face-to-face with this problem? Scroll down to the next solution.

Add a Deposit Schedule for a New Item

If you have added a new employee, but have not assigned some items in the deposit schedule, it can result in certain liabilities not showing up. To fix this, follow the steps below:

- Open QB Desktop

- Navigate to the Employees Menu

- Click on Payroll Center

- Click on the Pay Liabilities tab

- Then, select Change Payment Method

- Go to Benefits and Other Payments

- Press Continue

- Mark the item you want to assign a schedule to

- Then click Edit

- Assign the payment schedule

- Finally, click on Finish

After assigning the deposit schedule, you won’t face this issue again.

Verify the Payment Made for Payroll Liabilities

One of the reasons you might be dealing with QuickBooks Payroll liabilities not showing can be that a payment or adjustment has already been made. To verify this, follow the steps below:

- Open the QBDT application

- Go to the Employees menu

- Click on the Payroll Center

- Then, navigate to the Transactions tab

- Check the following

- Year-to-date Adjustments List

- Liability Adjustments

- Liability checks

- Then, proceed to filtering the payments that are within this calendar year or the previous calendar year

- If you are unable to locate any, check the Payroll Liability Balances

- Now, modify the date range and choose TOTAL balance

- View details for each liability item

- An existing adjustment and a liability check for each liability item should be present

Implementing this method will help you recognize if you have already made payments for the liabilities.

QuickBooks Payroll Liabilities Not Showing Up – A Quick View

A concise summary of this blog on payroll liabilities not showing up in QuickBooks is given below in a tabulated format:

| Description | QuickBooks Payroll liabilities not showing is a common problem that users face, which renders them unable to view the payroll liabilities, resulting in unpaid payments. This is a serious issue and should be fixed on time. |

| Causes | Wrongly mapped payroll items within various liabilities accounts, the account used to see your payroll liabilities might be inactive, the fed date range in your payroll liabilities can be wrong, using an outdated version of QuickBooks Desktop, using an outdated version of QB Payroll and Payroll Tax Table, incorrect categorization of the QB Payroll list, Windows Firewall and other AV software obstructing QB, or you have not assigned a payroll schedule for a newly added payroll item. |

| Methods to fix | Updating QB Desktop to the latest version, activating your payroll liability account, modifying the date of payroll liability checks, scheduling the frequency of your payments, mapping your payroll items the right way, configuring Firewall if it’s blocking QB, verifying and rebuilding the data file, verifying the payment info received from agencies, setting up a payment schedule for a new employee, changing payroll liabilities, deleting tax liability records, updating the QB company file, checking QuickBooks Payroll liability report, adding a deposit schedule for a new item, verifying the payment made for liabilities. |

Conclusion

In this blog, we touched on the topic of QuickBooks Payroll liabilities not showing up. We explained to you the different factors that can cause this issue, and provided you with a step-by-step guide you can follow to get rid of this issue. If somehow you’re still at bay with this problem, contact our ProAdvisor Solutions professionals at 1-855-888-3080 today.

FAQs

Why are my payroll liabilities not showing up QuickBooks?

There can be several different reasons as to why your payroll liabilities are not showing up in QuickBooks. Some of them include incorrectly mapped payroll items, the payroll liability account being inactive, a wrong date range of payroll liabilities, and using outdated QB Desktop. Additionally, an outdated payroll tax table and a wrongly configured Windows Firewall can also cause this issue.

How do I fix payroll liabilities in QuickBooks?

To do so, open the company file, browse to the Employees menu, and click on Payroll Taxes and Liabilities. Then, press Adjust Payroll Liabilities and choose the paycheck date in the Date and Effective Date field. Now, under the Adjustment is for section, click Company. Go to the Item Name column and select the item you want to adjust. Adjust it in the Pay Liabilities tab and click on OK. Finally, click on Accounts Affected and hit OK.

How to record payroll tax liabilities in QuickBooks?

To record tax liabilities, browse to Taxes and press Payroll tax. Then, click on Pay Taxes and select Record Payment for the tax you want to record.

More useful articles:

QuickBooks Tax Table Not Updating? Here’s How to fix It

Fix QuickBooks Check Alignment Problems With 100% Working Solutions

10 Solutions for QuickBooks Not Printing Checks Correctly

QuickBooks Migration Tool : Download, Setup and Utilize

How to fix QuickBooks Abort Error Effectively?

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.