QuickBooks Payroll assists users in the best way possible with its up-to-date features and regular updates to keep up the smooth working of the application. Users around the world have used this application to manage paychecks while paying employees effortlessly with direct deposit. Now, at times when users try to get the latest payroll updates, they may face the QuickBooks Payroll Error PS058. The error interrupts the process of downloading payroll updates and eventually affects various other program’s operations. Suppose you, as a user, have faced this issue. In that case, you are at the right place where we will be talking about triggers and solutions to manually remove QuickBooks error PS058 and successfully install the latest updates.

There can be several problems while working with QuickBooks payroll services. Some can arise due to outdated tax tables, and some can be due to missing file components. These QuickBooks errors can be fixed with simple and quick methods. However, some technical errors may require an expert’s assistance in resolution. So, if you cannot resolve the QuickBooks error PS058, you can contact the Proadvisor solutions’ experts at the toll-free number 1.855.888.3080.

Table of Contents

What is QuickBooks Error PS058?

Error PS058 is among the series of PSXXX errors in QuickBooks that usually occurs when you try to download or install any payroll-related update. QuickBooks Error PS058 is a common error that irritates users during and after every payroll update. Error PS058 in QuickBooks is generally caused because of a corrupted or damaged company file. Understanding the causes of the error will help you in identifying the perfect solution for it. Let’s try to look at the possible causes of the error PS058 in QuickBooks.

Scenario That Triggers QuickBooks Payroll Error PS058

QuickBooks payroll services handle a lot of whole things at once. So, there can be several factors that can contribute to the payroll error PS058 in QuickBooks Desktop. Some of the scenarios where QB error PS058 can be triggered are:

- Damaged or corrupted QuickBooks company files are one of the primary triggers for error code PS058.

- There is some internal issue in the Windows component files.

- The default location of the QuickBooks company data file is other than the C: Drive.

- The Windows Firewall or an anti-virus application installed on the system is hampering the update process and resulting in error PS058.

- Your current Payroll subscription is inactive.

- The Employee Identification Number (EIN) in the company file is inaccurate.

These are some of the popular cases in which QuickBooks can trigger payroll error PS058. Let’s now have a look at the simple and quick steps to fix the error manually.

You May Also Like To Read – Solution Of QuickBooks Keeps Crashing Issue

How to Fix Payroll Error PS058 in QuickBooks?

Time to look at the step-by-step process to fix the error code PS058. You must be careful in following these steps to solve the error quickly.

Solution 1: Reviewing the Payroll Service Subscription

This first step will help you check if your current payroll subscription is active. Since an inactive subscription is a reason for QuickBooks payroll error PS058, you must review it using the steps below.

- You must first close QuickBooks and the company files.

- Soon after, restart the system.

- Launch QuickBooks and click on Employees.

- Select the My Payroll Service option and then Manage Service Key.

- Review the Service Name and Status options which must say Active.

- Click on Edit to check your service key number. If you see the key is incorrect, make the required changes and click on Next.

- Unmark the Open Payroll Setup box.

- Click on Finish.

- The payroll update should start downloading after the above details are updated.

If you still see the QuickBooks payroll error PS058, move to the next step.

Step 2: Download the Latest QuickBooks Updates

When your QuickBooks is outdated, it is common to encounter various error codes. Therefore, our experts suggest updating QuickBooks to tackle payroll errors.

- First, close the opened company files and QuickBooks Desktop application.

- Next, click on the Start menu and look for QuickBooks Desktop.

- On finding the icon, right-click on the icon and choose Run as administrator.

- This command leads to the No Company Open screen.

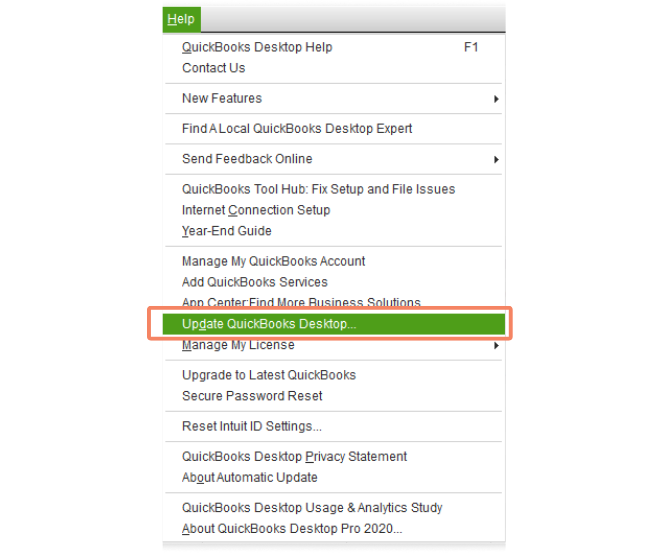

- Select the Help menu.

- Click on Update QuickBooks Desktop.

- Now use the Options tab and choose Mark All.

- Select the Save option.

- Hit the Update Now tab and then the Reset Update checkbox.

- Finally, use the Get Updates button and let the process complete.

You must close and reopen QuickBooks Desktop. On your screen, click on Yes to bring the updates to effect, restart your system.

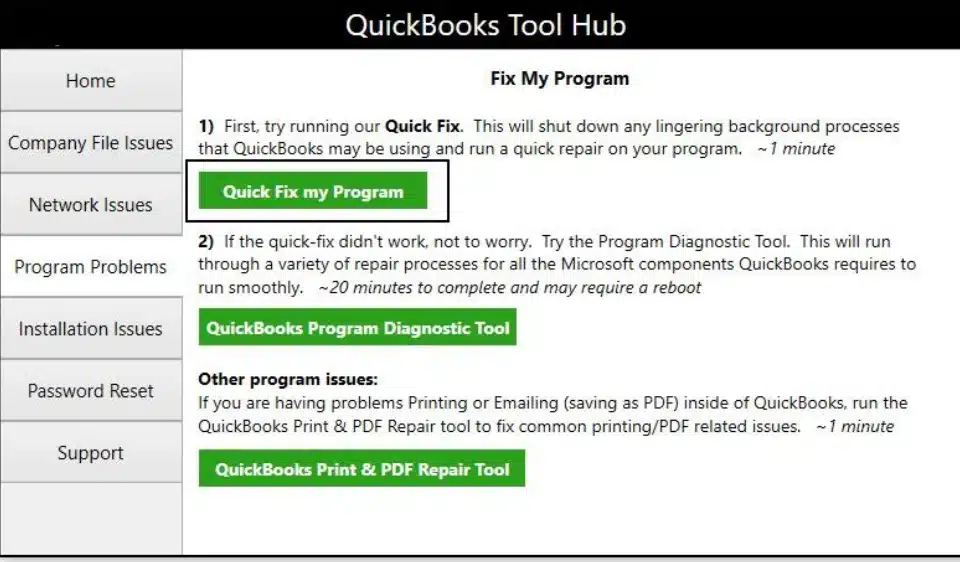

Step 3: Run Quick Fix my Program

Quick Fix my program is an option available under QB Tool Hub. Tool Hub is an external tool that allows users to manage common errors in QuickBooks, and, therefore, this is another step in which you can tackle QuickBooks Payroll Error PS058.

- If you still have QuickBooks and data file open, close it.

- Now open the web browser to get the QuickBooks Tool Hub.

- You will be prompted to select a location on your computer to save the download file. We suggest you choose an easily accessible location.

- After the file is on your system, double-click on it to install the Tool hub and complete the process with the on-screen steps.

- Additionally, you must agree to the Terms and Conditions.

- Next, you must double-click on the QuickBooks Tool Hub icon.

- Once you are on the QuickBooks Tools Hub, choose the Program Problems option.

- Click on Quick Fix my Program.

- Get the latest tax table and see if payroll update can complete without error.

Recommended To Read – Fix of QuickBooks Cannot Communicate with the Company File Issue

Step 4: Run the Reboot.bat File

You must try running the reboot.bat file to resolve issues present in the QuickBooks program. As a result, you will be able to update payroll after issues from the application are successfully tackled. Here is how you can accomplish these steps.

- You must access the folder that has the reboot.bat file.

- Now navigate to the QuickBooks Desktop icon and right-click on the icon.

- Choose Properties.

- Select Open file location to go to the location of the reboot.bat file.

- Right-click on the reboot.bat file and choose the Run as Administrator option.

Finally, log in to your QuickBooks application with the admin credentials and see if QuickBooks payroll error PS058 persists.

Solution 5: Running an Error Scan in the Company File

Sometimes, running an error scan option in the company file can help fix small mistakes in the QuickBooks Desktop. You need to follow the steps mentioned below to run an error scan in the company file.

- Open the QuickBooks Desktop application and press CTRl+1 or F2 keys to open the Product Infomation Window.

- Now, you need to press the Control+2 or F3 keys in the Product Information Window.

- There, you need to select Tech Window Help and click on Open File.

- You need to search for the qbwin.log file and double-click on it.

- Now, search for ‘Error’ by pressing Control+F keys together.

- Finally, you need to spot the numerical error code and find the same on the website.

Running an error scan in the company file can help you with both error identification and fixing methods. You can proceed to the next solution if this does not work out.

Solution 6: Utilizing the RegCure Option in QuickBooks

The users must try using the RegCure options in QuickBooks for the resolution of the error PS058 in QuickBooks. The methods for utilizing the RegCure option are mentioned below:

- First, you need to use the keys Ctrl+alt+del to open Task Manager.

- There, you need to look in the program list for qbupdate.exe and qbdagent.exe.

- If you are able to locate these programs, you need to close them.

- In the research window, type reboot.bat now.

- The DOS-type shell will open when you double-click the file.

- You need to hold off till it closes by itself.

Finally, you need to download payroll updates after restarting your computer.

Summing It Up!

This six-step-wise solution mentioned above can solve the payroll-related QuickBooks Payroll Error PS058. However, you must be cautious in following the steps as a mistake can further damage the data files. If you still face the error, we suggest you must contact the Proadvisor solutions support team on 1.855.888.3080 for expert guidance on the case and fixing the error successfully.

Frequently Asked Questions (FAQs)

What is QuickBooks error PS058?

Error PS058 in QuickBooks is among the series of PSXXX errors in QuickBooks that usually occurs when you try to download or install any payroll-related update. Error PS058 in QuickBooks is generally caused because of a corrupted or damaged company file.

What are the common causes of QuickBooks Error Code PS058?

QuickBooks error PS058 can be caused by corrupted Windows Files, communication blockage, unavailability of company files on the drive, inactive payroll subscription, or inaccurate Employee Identification Number.

How can I fix QuickBooks Error PS058?

If you are trying to fix QB error PS058, you can restart your computer, update your QuickBooks desktop, recheck the internet connection, update the latest tax table, or run the error scan file in QuickBooks Desktop.

How can I fix QuickBooks error PS058 from happening again in the future?

To prevent error PS058 from happening again, you must keep updating QuickBooks Desktop, also ensure you have a stable internet connection, and you need to check for maintenance updates for company files regularly.

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.