Any application that is installed on your system needs regular updates to tackle minor errors in it. In a similar fashion, QuickBooks Payroll needs timely updates to fix any glitches. At times while downloading such updates, an error message “QuickBooks Payroll Error PS034: The payroll update did not complete successfully.” may pop up. We are here to help you resolve this error so that you can keep the payroll up to date and save the crucial data from damage by some internal errors.

The troubleshooting methods mentioned below will help you eliminate the payroll update problems seamlessly. However, if you don’t wish to self-troubleshoot the error or aren’t tech-savvy enough to undertake the process, you must contact our Proadvisor solutions support team to get the best assistance for QB payroll update issues.

Table of Contents

Main Causes Of QuickBooks Payroll Error PS034?

Any of the following causes these error codes. Review these reasons to quickly find the right step to solve Payroll Error PS034 in QuickBooks.

- The internet connection settings are incorrect.

- The setting of your firewall blocks the process of updating QuickBooks payroll.

- Another reason for QuickBooks error Code PS034 is a damaged file in the CPS folder.

- Your current payroll subscription status might be expired or inactive, which can prevent QB from updating the function.

- Misconfigured UAC settings can be another factor that triggers QuickBooks Desktop error PS034.

- This may be due to your QBDT application being damaged or corrupted or due to a faulty or incomplete installation.

Recommended to read: How to fix QuickBooks Error 15103

Top 7 Methods to fix Payroll Error PS034 in QuickBooks?

After studying the reasons for payroll error PS034 in QuickBooks, time to start fixing the error manually. We have listed various steps that you can employ to solve the error without external help, and they have proved helpful for multiple users, and we hope the same for you.

Method 1: Review your current payroll service subscription

Incorrect details in your payroll subscription can lead to Payroll Error PS034 in QuickBooks. In this method, we will study the details of payroll service subscriptions and see if it is causing the error.

- After closing your QuickBooks company file, restart the system.

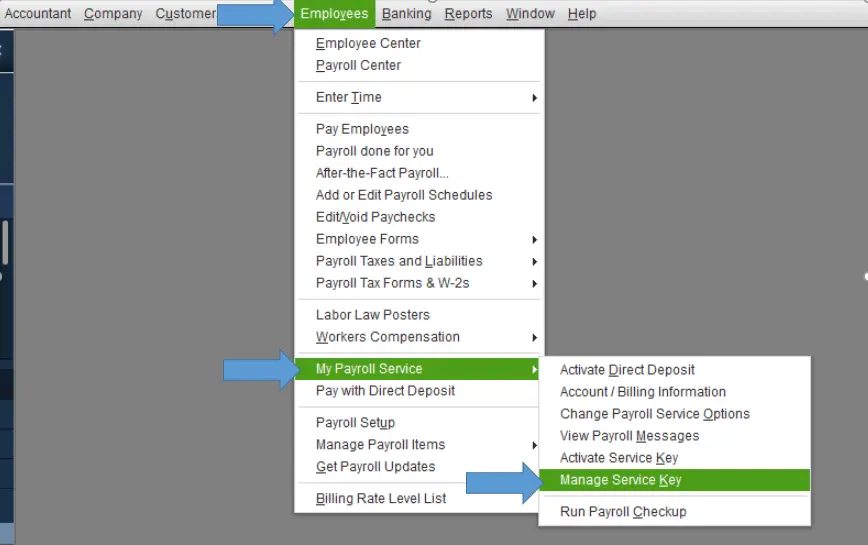

- Reopen the QuickBooks application and click on Employees.

- Choose the My Payroll Service subscription option.

- Click on Manage Service Key.

- Review the Service Name and Status to be correct.

- In addition, it must be Active.

- Click on the Edit icon and confirm the service key number. If it is not accurate, fill in the correct number.

- Choose Next, and you must unselect the Open Payroll Setup option.

- Click on Finish, and you will have the entire payroll update downloaded.

Method 2: Modify the User Account Control Settings to fix QuickBooks Payroll Error PS034

The User Account Control (UAC) settings protect your computer from internet threats that may appear after downloading files online. As a result, these settings may treat payroll updates as a threat and lead to QuickBooks payroll error PS034. We will guide you to turn off the UAC to fix this error.

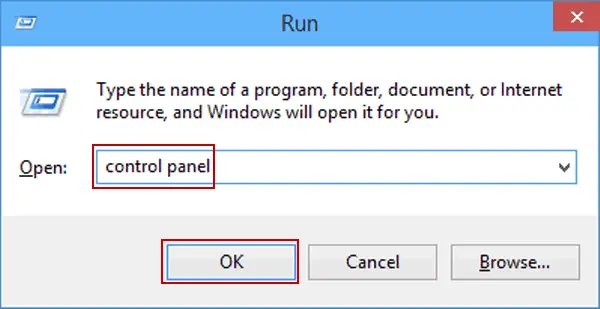

- Go Windows icon and use the search box and type Control Panel.

- Press the Enter key, which will launch a window in front of you.

- Click on User Accounts.

- Select the User Accounts (Classic View) option.

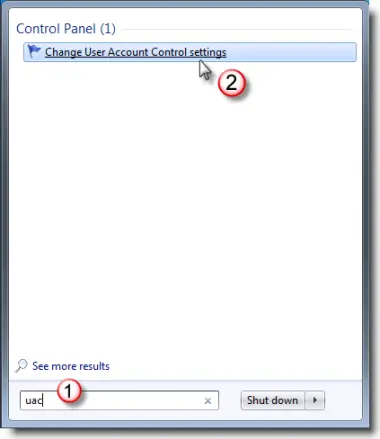

- Navigate to the “Change user account control settings” section and confirm with a Yes.

- With a slider on your screen, you can navigate between two options.

- Use the slider to select Never Notify, which will disable the UAC.

- Hit the Yes button and reboot the computer to bring the changes to effect.

Method 3: Make use of Quick Fix my Program using the QuickBooks Tool Hub

QuickBooks Tool Hub is a tool by Intuit, and it is useful for users to deal with some common errors in QuickBooks. We will use this tool to fix the Payroll Error PS034. If the QuickBooks application is open, close it and on Windows 10, 64-bit, download the Tool Hub using the following steps.

- Open your web browser.

- Go to Intuit’s website to download the latest version (1.5.0.0) of the Tool Hub.

- You must save this file at a location where you won’t forget it. We suggest saving it in the Downloads folder or the Windows desktop.

- Once the download is complete, access the file by opening it. The file is saved as QuickBooksToolHub.exe.

- Use the instruction as they appear on the screen to install Tool Hub and agree to the terms and conditions.

- Double-click the icon on your Windows desktop to open the tool hub when the installation finishes.

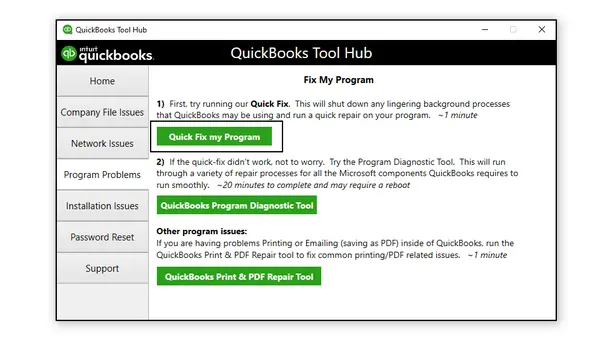

- Once QuickBooks Tool Hub icons appear on your screen, you must now use the Quick Fix function to solve the payroll update error.

With Quick Fix, the background processes used by QuickBooks are shut down, and repairing of the application will initiate.

- Open the QuickBooks Tool Hub and click on Program Problems.

- Choose the Quick Fix my Program option.

- Launch the QuickBooks Desktop application and open your data file.

Read Also: I am getting QuickBooks Error 15104

Method 4: Rename the QuickBooks CPS Folder to eliminate QuickBooks Payroll Error PS034

The Damaged CPS Folder of QuickBooks significantly contributes to the Payroll Update Error PS034. By renaming this folder, a new version of it is created, which can reverse the glitch caused by the old one. Here is how you can rename the QuickBooks CPS folder.

- After shutting down the QuickBooks application, navigate to the Start menu.

- Use the Windows key along with the E key to launch the File Explorer window.

- Click on This PC.

- Double-click the C: Drive option.

- Search for the Program Files (x86) folder or the Program Files folder.

- Open the files.

- Now you must go to the Intuit folder and launch the QB folder for the version of QuickBooks that you use.

- Access the Components folder and select the Payroll folder.

- After seeing the CPS folder, right-click on it and choose the Rename option.

- Add OLD as the suffix to the folder name. It will appear as CPSOLD.

- Now you must create a new CPS folder on your desktop.

- Copy CPSOLD and paste it into this newly created folder.

- At last, successfully update payroll.

Method 5: Remove the Duplicate Copies of QBDT on your PC

If you have multiple copies of QuickBooks on your device, it not only creates ambiguity but can also lead to issues while updating the application. Hence, you can address QuickBooks update error PS034 by using the troubleshooting steps to remove duplicates as follows –

- Open the Run command prompt by pressing the Windows + R keys, then access the Control Panel by searching for it in the search field and click OK.

- Now, select the Programs and Features menu, then proceed by selecting Uninstall a Program and open the program list.

- Locate identical QuickBooks Desktop versions to figure out the duplicates, then select the copies and click Uninstall/Change to remove them from the PC.

Once the duplicates are removed and there is only a single QBDT version on your PC, rerun the QB and payroll updates. However, if QuickBooks error PS034 prevents you from completing the update, follow the steps mentioned in the next solution to eliminate the error code.

Method 6: Configure your PC’s Antivirus and Firewall Setup

If your PC’s firewall app is set to block QuickBooks, QBDT won’t be able to access the internet to download the updates. This scenario can prompt many update errors, including QuickBooks update error PS034. To resolve the firewall blockage and remove the error code, you must reconfigure the Windows firewall and antivirus application.

After the configuration process ends, rerun QuickBooks and try to download the payroll updates to check if the error is dismissed. If not, move to the next troubleshooting method and follow the given steps to address the PS series error.

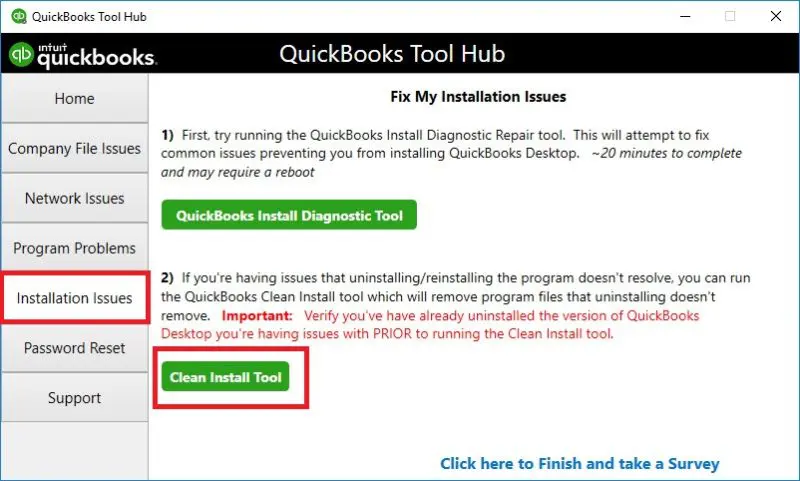

Method 7: Clean Install QuickBooks

If none of the given methods help you eliminate the update error, you must try reinstalling QuickBooks as the last resolution step. To reinstall the application, you must use the QuickBooks Clean Install tool to uninstall and install a fresh QBDT version.

Once the reinstallation is complete, you must rerun the update process to ensure the payroll update issues are rectified.

Ending the Guide…..

This blog is specifically curated with the best solutions to help QB users resolve QuickBooks Error PS034 without hassle. But, sometimes, these methods might not work, and the error keeps appearing, which can be very frustrating. In such cases, we advise you to take assistance from our specialists, who are experienced in dealing with such intricate errors and problems. You can contact our Proadvisor solutions support team and our specialists will help you every step of the way to address this PS series error.

Common User Questions

What are the steps to register the payroll service in my QuickBooks Desktop application?

You can use the instructions given below to register/set the payroll service in your QBDT –

– First, set up the payroll tab by selecting the Payroll section and using the task list.

– Then, add your employees in the Payroll tab and select the Company Preferences from the Preferences tab of the Edit section.

– Lastly, ensure that the full payroll is selected and import your data, such as W-4, direct deposit info, and paycheck details.

Is it important to use admin rights when initiating the update process in QB?

Yes, certain specific actions in QuickBooks Desktop require admin rights; otherwise, the actions won’t be complete. The update process is one such task that cannot be undertaken without logging in to the QBDT program with your admin credentials.

Are there any other miscellaneous solutions that might help fix the QB error PS034?

Yes, if the given troubleshooting methods are exhausted and the error pertains, you must use the following solutions to address it –

– Check the date and time setup on your PC to ensure the date and time zone are correct.

– Ensure QB is running in a single-user environment while undertaking the QB and payroll update process.

– Scan your system files for any infections and ensure the Windows OS is updated.

Also Read :-

How do I correct the QuickBooks error PS038 fast?

How to Fix ‘QuickBooks Unable to Locate PDF Viewer’ Issue

How to Fix QuickBooks Payroll Error Code 2107

What is error code 2308 in QuickBooks Desktop?

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.