QuickBooks is widely used among small and medium-sized businesses for accounting and bookkeeping. It provides a wide range of tools and features to make these processes easier for its users. When you run a business, you have to deal with inventory items. There is a prevalent issue of incorrect COGS in QuickBooks involving inventory items. It suggests that the cost of goods sold has been calculated wrong. The error occurs when you try to fetch your Profit and Loss report. You either get negative or missing COGS in the report. In this article, we will discuss the reasons why you may get incorrect QuickBooks COGS and the ways through which you can fix it.

“If you come across Incorrect COGS in QuickBooks in your Profit and Loss report and you need to resolve it, contact ProAdvisor Solutions’ Accounting Support at 1.855.888.3080”

You may also see: QuickBooks Online Undo Reconciliation

Table of Contents

Reasons why QuickBooks is Showing Incorrect Cogs?

There are various possible reasons that can result in QuickBooks showing incorrect COGS. These have been listed below for you:

- If the entered item

received value is wrong, the COGS calculated amount would also be incorrect. - Inventory item cost not set

up, and if the item’s cost is entered after selling it, then it can also cause

the error. - Incorrect COGS amount will

cause the issue when the data is exported to QuickBooks Point of Sales. - If the changes made to the COGS

account does not display in POS. - If the transactions

recorded by POS get deleted from QuickBooks, then the error will occur. - Items purchased in bulk and

sold one at a time can be a reason behind the error.

Now as you understand the reasons that can cause the issue of incorrect COGS in QuickBooks you would be able to comprehend the exact reason that has caused the error and implement the troubleshooting methods accordingly.

COGS Account Balance Incorrect! Here’s How to Fix it

The COGS account balance incorrect issue can be resolved through various methods depending on the reason causing it. You can follow the methods given below to resolve the error easily:

Method 1: Verifying if the Cost of Item Sold is Correct

You should verify that the cost of the item sold is entered correctly in QuickBooks. Follow the steps as provided below:

- Go to the ‘Reports’ tab, select ‘Sales,’ and then click on ‘Item Summary.’

- Click on the ‘Modify’ and then select the ‘Revert’ option.

- You need to sort the items from the ‘Item Name’ section.

- Find if there is any item with $0.0 in the Ext cost section.

- Take note of items that do not have any cost set up.

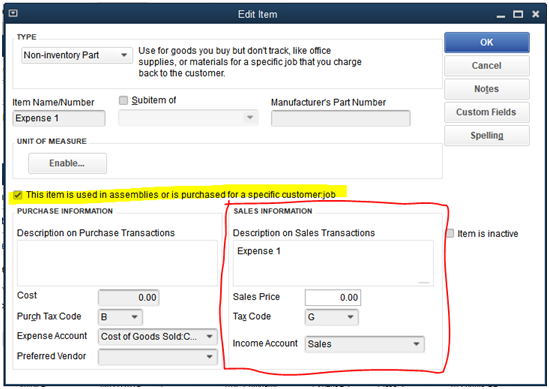

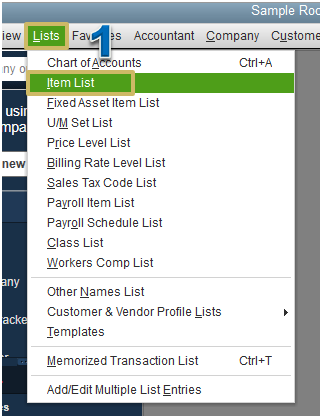

- Reach the Inventory section now and then select ‘Item List.’

- Check the history to know the number of times the item was sold without any cost, and then select the ‘Edit’ option.

- Calculate the total amount that has been sold without any cost.

- To correct the error, you need to create a new journal entry crediting the amount to the COGS account and debiting from Inventory Assets. Go to the ‘Reports’ tab, select ‘Sales,’ and then click on ‘Item Summary.’

- Click on the ‘Modify’ and then select the ‘Revert’ option.

- You need to sort the items from the ‘Item Name’ section.

- Find if there is any item with $0.0 in the Ext cost section.

This should fix the Incorrect COGS in QuickBooks issue if it occurred due to items sold without any cost set up. If you did not find any such item, then keep reading the article for other methods to resolve the issue.

Method 2: Ensure that the Correct COGS Account is Set up

- Open the QuickBooks POS application and reach the ‘File’ menu.

- Select the ‘Preferences’ option and then choose the ‘Company’ option.

- Click ‘Financial’ and then select the ‘Accounts’ option.

- You need to verify that the correct COGS account has been selected for each listed item.

- Now, select the ‘Item List’ option from the ‘Inventory’ section.

- Select the option to ‘Customize Columns’ from the ‘Column’ header.

- Check and verify that the set Cost of Goods Account is correct.

- If the account is not correct, then click on the ‘Item List’ and choose the correct account for it.

- Open the QuickBooks Desktop application and create a journal entry to transfer the amount to the correct account.

Method 3: Removing Erroneous Adjustments in POS

- Open the QuickBooks POS and go to the ‘Inventory’ section.

- Click on the ‘Quantity Adjustment History’ option.

- Go to the ‘Column Header’ and choose ‘Customize.’

- Now move to the Diff Cost section and then click on the ‘Save’ button.

- You should note if any erroneous quantity adjustments were made in the Diff Cost section.

- Double-click on an entry, and click on ‘I want to view Financial History.’

- Select the ‘Open in QuickBooks’ option, then click on ‘Inventory,’ and then select ‘Cost Adjustment History.’

- If you see any erroneous adjustment, click on ‘I want to’ and select ‘Reverse Memo’ from Cost adjustment history.

- Move the fund to the correct account through a journal entry.

Method 4: Resolving QuickBooks COGS Incorrect by Checking Deleted POS Transactions

Follow the steps provided below to check deleted POS transactions and resolve the QuickBooks COGS incorrect issue:

- Reach the ‘Sales History’

section and then click on the ‘I want to’ option. - Click on the ‘Show

Financial Details’ option. - If the status in financial

details shows “successfully sent to

QuickBooks, but it is not open in QuickBooks”, then the entry is deleted. - If you cannot find the receipt

in QuickBooks, click on the ‘Resend this document during the next Financial

Exchange’ option. - If the status of the receipt

shows “Not Sent,” ensure that the ‘Mark as sent’ checkbox is

unmarked. - Press the ‘OK’

button for the changes to take effect.

You may also read: QuickBooks Online Not Working with Chrome

These steps should help you resolve the issue of incorrect COGS in QuickBooks yourself. This article discussed the various reasons why you may face this issue in your Profit & Loss report. We also discussed effective measures to get rid of the issue. You should be able to easily resolve the error, but if you are struggling and need assistance from an expert, contact ProAdvisor Solutions’ Customer Care at 1.855.888.3080.

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.