QuickBooks error 2308 can drop like an unexpected bomb when you try submitting your payroll or using the direct deposit feature. With the warning message repeatedly arising on the screen, you can’t do much but comply with it and set straight to resolving the error. However, you may find that not enough resolutions or assistance is available to get rid of this error. Watching these circumstances, our ProAdvisor team has come forward with detailed rectification approaches, along with additional reasons and signs of the error, which will help you work error-free and burden-free.

QuickBooks Payroll is a feature of the popular accounting software QuickBooks, whose design assists businesses in streamlining their payroll processes. It provides tools and functionality to manage employee compensation, calculate payroll taxes, generate paychecks, and handle direct deposits. Direct deposit is a unique QB payroll characteristic, enabling electronic funds transfer from an employer’s bank account to an employee’s bank account. With QuickBooks Payroll, QB users can seamlessly set up direct deposits for their employees, eradicating the need for paper checks and simplifying the payment process.

While all this seems excellent in theory, the actual picture may be riddled with multiple errors and glitches, like the message code 2308, indicating one or more issues with the system. These bugs stop users from operating without hassles. In this detailed guide, we intend to eliminate all these problems you’re encountering and ensure no such issue arises again.

Has QuickBooks error 2308 been annoying you by repeatedly popping up while submitting payroll or directly depositing QuickBooks? Worry not, as our proficient team is a call away at 1.855.888.3080 to let you work on QuickBooks hassle-free and seamlessly. We ensure to safeguard your data while eliminating all the errors from your system

Table of Contents

What is QuickBooks Error Code 2308?

QuickBooks error code 2308 erupts while expending efforts to submit payroll or direct deposit paychecks. It is a run-time payroll service error, indicating a broken connection with the payroll server, inaccurate bank account details, or other issues due to which your sign-in gets rejected.

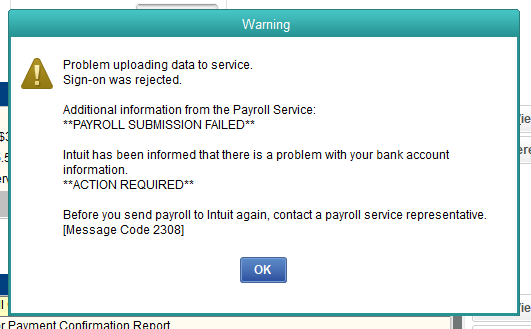

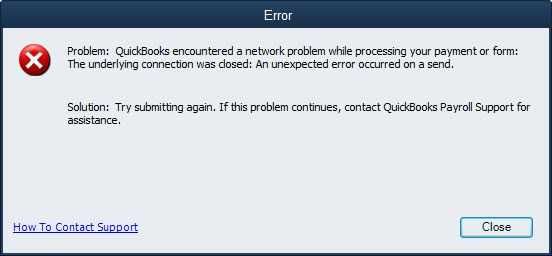

A sample of the error message one of the QuickBooks users encountered, where this error code was mentioned, is as follows:

“Warning

Problem uploading data to service.

Sign-on was rejected.

Additional Information from the Payroll Service

**PAYROLL SUBMISSION FAILED**

Intuit has been informed that there is a problem with your bank account information.

**ACTION REQUIRED**

Before you send payroll to Intuit again, contact a payroll service representative.

(Message Code 2308)

OK”

When we break down this warning message in detail, you’ll understand that various aspects are covered, as QuickBooks indicates a failure in payroll submission. Let’s crack down on these elements and learn about them in-depth before we investigate the reasons and troubleshooting solutions:

A Sign-on Rejection Warning

QuickBooks warned users that their attempt to sign on was refused because the application encountered issues while uploading data to the service. It means users’ account credentials could not be authenticated or verified successfully because they were invalid, expired, or incorrect.

Inability to Submit Payroll

Additionally, since error 2308 appears while submitting payroll, the warning message clarifies that you can’t offer it as the procedure failed.

Issues with the Bank Account Information

A reason proposed by the warning message behind payroll submission failure is problems with your bank account information. It means the details you added to your bank account login/ required fields in QB may have inaccurate account numbers, outdated details, or conflicting information between QuickBooks and the bank.

A Prompt Action is Required

All these details and caution messages prompt users to take immediate corrective action and eliminate QuickBooks error 2308. When you get this error, the recommended course of action is to let the payroll representatives at QuickBooks know about your ordeal. Since they possess the necessary technical knowledge about these issues, they can suggest immediate relief methods to implement. Further, they can ensure your banking details remain up-to-date, and your data is secured.

A 2308 Error Message Code

What confirms the presence of QuickBooks 2024 Error 2308 is a message code at the end of the notification. This code is beneficial when you have to communicate the exact problem you’re facing to the payroll representative. Further, these codes are connected to specific issues and help identify the root cause of your problems. Let your QuickBooks support person know the case, and they’ll be on their way to help you eliminate it.

Thus, users encountering this error message find significant challenges in carrying out payroll submissions and direct deposits. The frustrations and work disruptions due to this error require instant relief, so we have mentioned the exact triggers of the error below. You can now understand why error 2308 arises to strike up straightforward remedies.

Recommended to read : How To Fix QuickBooks Error 6000 1074

Triggering Factors for QuickBooks Error 2308

The mind-boggling reasons why you experience QuickBooks 2023 error code 2308 are given below:

| Sr. No. | Basis | Description |

| 1. | Invalid Security Certificate | Your program may be encountering trouble connecting with the QuickBooks payroll server while it keeps showing a network timeout. |

| 2. | Undertaking activities with an ON multi-user mode | The QuickBooks program may have an active connection to the network while you submit payroll data. It means you might be sending your payroll details while the multi-user mode is ON, which creates errors like 2308. |

| 3. | Frequent Network Timeouts | Your program may be encountering trouble connecting with the QuickBooks payroll server while it keeps showing network timeout. |

| 4. | General Internet Connection Problems | Another error 2308 triggers are general internet connectivity problems due to a misconfigured router, intermittent internet connection, etc. |

| 5. | Restrictive Firewall and Internet Security Settings | While your internet browser doesn’t consider QuickBooks/ Intuit a trusted website to be added to the Trusted Sites list, your antivirus or firewall settings may also treat the program as dangerous. Thus, you may fall prey to QuickBooks error 2308, unable to submit payroll and direct deposit paychecks. |

| 6. | Wrong System Time and Date Properties | If you haven’t noticed the time and date on your computer yet, do it now, as it may be inaccurate and lead to QuickBooks error 2308. |

| 7. | Incorrect Bank Account Details | If you read the error message, you’ll find one reason for the error 2308. Incorrect bank account details, login credentials, conflicting information, etc., can trigger this error. |

| 8. | Failure to Authenticate Account Information | The account you’re using to submit your payroll or facilitate direct deposits may fail the authentication procedure set by QuickBooks. You must check these details beforehand to ensure it’s an accident and not something done maliciously. |

| 9. | Expired or Invalid Authorization | If the authorization to access your bank account for direct deposit has expired or become invalid, it can result in the rejection of the sign-on process. This procedure can happen if you have changed your bank account or had issues with the initial authorization setup. |

| 10. | Account-related Problems | Users can undergo sign-in rejections because specific account-related issues, such as a frozen or closed bank account emerge. These problems push the narrative of ensuring that your bank account is active, in good standing, and not subject to any restrictions. |

| 11. | Intuit system or service issues | In some cases, you may encounter the error 2308 due to technical problems on the Intuit side. It could be related to their servers, databases, or other backend systems. These issues are typically resolved by the Intuit technical team, and contacting a payroll service representative will help you get the necessary assistance. |

| 12. | Other Interruptions | Various specific circumstances with your payroll setup and others can contribute to error 2308. Compatibility issues between applications, software conflicts, connectivity errors, etc., can trigger QuickBooks error 2308. |

You can troubleshoot the annoying QuickBooks error once you verify your system for triggers and detect the actual cause for error 2308. However, it would help if you first were wary of the signs exhibited by this error, which you need to deal with until its resolution.

Symptoms Exhibited by QuickBooks Error 2308

While getting QuickBooks error message 2308 is one sign clarifying that you have become a victim of QuickBooks 2308 error, other indications also assist you in verifying its presence. The error message details different things about the error, a probable cause, a suggestion to contact a professional, indication that your activities have been disrupted, etc. Other known symptoms of error 2308 include:

Failed attempts to submit payroll

Your attempt to submit payroll through QuickBooks Payroll may repeatedly fail, preventing you from successfully processing payroll for your employees. You may encounter this annoying problem constantly or intermittently, depending on the nature of the issue.

Delayed or incomplete direct deposits

When the issue lies with your bank account information, you’ll have to experience delayed or incomplete direct deposits for your employees. They may not receive their payroll payments on time or may only receive partial payments, which may cause dissatisfaction and conflicts with the management.

Bank Account Notifications

You may receive messages from your bank account about the failed attempts or other glitches caused by QuickBooks error 2308. Further, the QB program may also flash descriptions regarding problems with how your bank account information is processed.

Necessary Professional Intervention

The QuickBooks error message regarding the 2308 problem or other caution descriptions may prompt you to get a professional involved and fix this troubling issue. In fact, the error code mentioned explicitly in the message helps you communicate your problem transparently.

Unfavorable QuickBooks Functioning

Your QuickBooks program won’t function normally and will slow down while you push the buttons and try to work through the problems. It may result in frequent freezing, crashing, and slow responses from your application, which affects the overall performance and experience with the program.

Delayed Productivity and Disruptions

QuickBooks error 2308 doesn’t let you work, send payroll, and deposit paychecks on time to your employees. While your employees get demotivated due to this issue, the business may suffer from lagging productivity and considerable troubles.

These points are the leading evidence of why you can’t keep running your program without immediately resolving QuickBooks error 2308. The significance of a smooth-running app comes to light with this error. So, let’s get our QuickBooks program functioning hassle-free with efficient resolution methods to fix the problem.

Read Also : I am getting QuickBooks Error 557

Pre-measures To Rectify QuickBooks Error 2308

Once you’ve gained fundamental knowledge about QuickBooks error 2308, you’re free to resolve it with expert resolutions. However, you can implement the troubleshooting methods for this error after you consider the following facts and accomplish them beforehand:

Update QuickBooks

The latest QuickBooks version is critical to run payroll and direct deposit paychecks. It is because the newest version will also have the necessary bug fixes, software improvements, and better security, which the past versions lacked. Therefore, before you start troubleshooting your QuickBooks error 2308, follow the steps to update QB Desktop as follows:

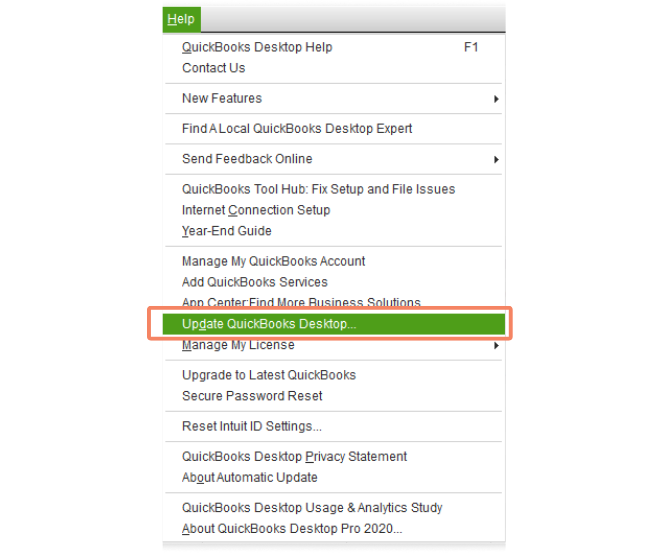

- The course of updating QuickBooks begins with launching the application and navigating to the Help menu.

- When the Help dropdown menu emerges, you need to choose Update QuickBooks Desktop.

- Next, follow the procedure by clicking the Update Now and Get Updates options.

- The latest QuickBooks update should commence downloading into the system. Once the download ends, you can initiate its installation with the Install Now option.

- Lastly, verify the QuickBooks update has been downloaded and installed successfully by pressing the Ctrl + 1 or F2 key in QuickBooks, which launches the Product Information window where details regarding your current QB version are visible.

Download the Most Recent QuickBooks Payroll Tax Tables

Along with the newest version of QuickBooks, you require the latest payroll tax tables, which affect payroll computation and accounting calculations. You can resend your payroll after you update QB and payroll tax tables, as these steps also act as resolution methods for QuickBooks message code 2308. The procedure to download the most recent payroll tax table requires the following actions:

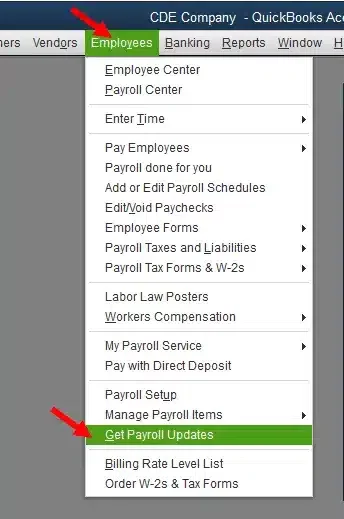

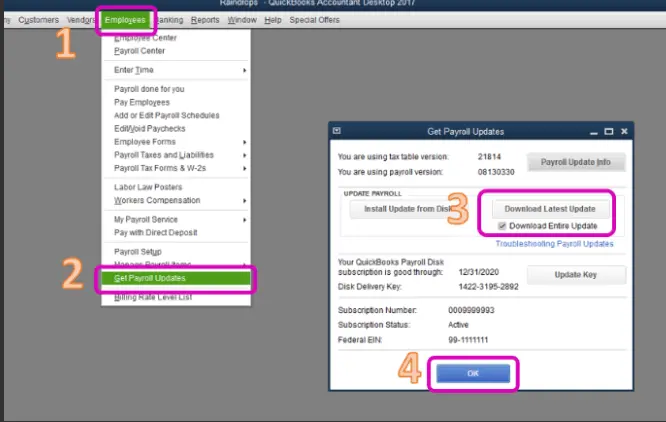

- The Employees menu will kickstart your journey to get the latest payroll tax tables. Under Employees, you will receive the Get Payroll Updates button.

- After clicking that button, you must learn about your current tax table version. Doing so will assist you in deciding whether a new table is needed. The tax table verification occurs by checking the number next to You are using tax table version.

- The tax table verification procedure in QB Payroll can be accomplished by watching the latest payroll news and updates. You can also find additional details about your payroll tax table version via the Payroll Update Info button.

- Now, if you know you need a new tax table, you can get it by opting for the Download Entire Update option. Then, tap Update.

- The conclusion of the procedure occurs when an informational window emerges and notifies about the successful completion of the update.

You may read also : What is QuickBooks Backup Failed

Ensure your QuickBooks Payroll Service is active

A QuickBooks payroll service without an active subscription can lead to significant errors, including QB error 2308. Users must prevent this issue by integrating an active payroll subscription into QB.

Make Sure You Set Up Payroll Seamlessly

If you haven’t set up QuickBooks payroll yet, you must arrange the settings seamlessly to run it without hassle. When configuring the initial setup settings, you manage the payroll preferences, enter employee details, and set up the bank account for payroll transactions. Thus, make future payroll processing seamless by inputting accurate information in the required fields.

A Reliable Internet Connection is Mandatory

It would help to have a robust and dependable internet connection when undertaking QuickBooks payroll subscriptions, services, features, and submissions. When the internet connection keeps fluctuating, the payroll functions take a hit and don’t work correctly.

Double-check Your Login Credentials

Your login credentials include your QuickBooks account and password details, which must be correct and up-to-date when entering your account. As an avid QuickBooks user, you must verify that the accounting credentials you use aren’t invalid or outdated, which may yield error 2308.

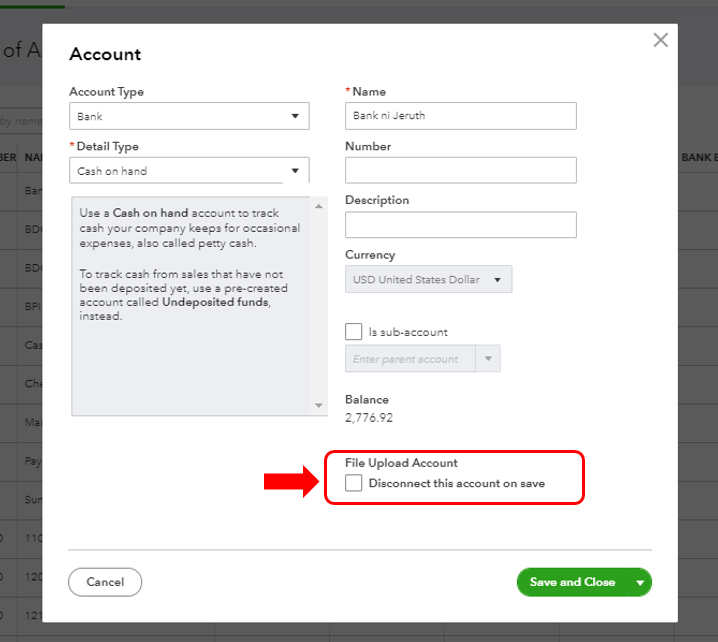

Revise Your Bank Account Info If Modified

Accurate and up-to-date banking information is required if a QuickBooks user functions on the platform and tries submitting payroll and direct deposits. The bank account details you need to review and adjust (if modified) include the routing number, bank name, account number, etc., to ensure the error 2308 doesn’t arise. The probability of your sign-in getting rejected is too high if your bank information is incorrect or out of date.

Check Software Compatibility and Firewall

QuickBooks users must ensure their software doesn’t conflict with any existing programs on the system or background processes. If it does, they need to terminate those tasks and activities. Similarly, they need to dig deep into their firewall settings and configure them by adding the QB port as an exception.

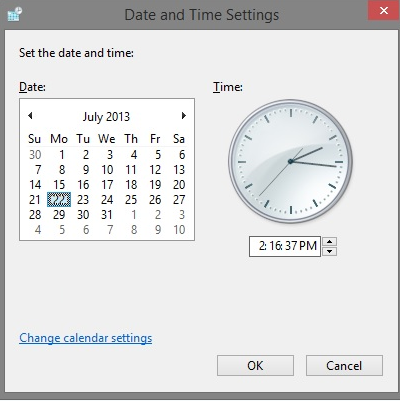

Take a Look at the System’s Date and Time

As demonstrated in the reasons, incorrect system time and date are significant contributors to QuickBooks error 2308. So, you can avoid this issue by looking at your system’s time and date on the right side of the taskbar. If it’s incorrect, we have mentioned the ways to correct your date and time zone in the solutions.

After considering these measures beforehand, we have curated a set of expert recommendations that will answer Why I Am Getting QuickBooks Error 2308.

Troubleshooting Methods to Fix QuickBooks Error 2308

Here’s an exploratory insight into how you can resolve QuickBooks error 2308:

Solution 1: Review and Adjust Your System’s Date and Time

After reviewing your system’s date and time as a prerequisite, if you find it faulty and capable of causing QuickBooks error 2308, you can implement the following steps in Windows and Mac operating systems, respectively, to get rid of the persisting error:

Steps in Windows

- The solution begins by going to the place where your time and date are situated in your system, aka the taskbar.

- When you get your cursor to the time and date section, right-click it and pick the Adjust Date/ Time or Date and Time Settings option.

- As you reach the Date and Time Settings window, make sure you switch ON the “Set Time Automatically” button. Using this option, you can ensure that the device synchronizes with the internet time server and chooses the correct time automatically.

- Sometimes, even after setting the date and time to Automatic, you may find it lagging and not scheduling the correct time. In such cases, you need to toggle OFF the “Set Time Automatically” button and instead opt for the Change option.

- After you opt for the Change option under the Change Date and Time section, ensure the necessary adjustments have occurred, and tap OK to store all the changes.

- If you deem it necessary, you can modify your time zone also, which will help you deal with QuickBooks error 2308. Altering the time zone doesn’t require much hassle, but hitting the “Change Time Zone” button and picking one from the dropdown is appropriate.

Steps in Mac OS

- When using a Mac operating system, the date and time settings can be altered via the Apple menu located at the screen’s top-left corner. You’ll find the System Preferences button here to tap.

- You’ll discover the Date and Time option as you proceed with the System Preferences.

- You can move forward with the “Set time and date automatically” button as you navigate the Date and Time Tab. The automatic option ensures you connect with the internet servers, which lets you synchronize and correct your date and time.

- As in Windows, the automatic time and date setup may fail to show accurate results in your macOS. In such circumstances, you’ve to adjust the settings manually via the “Set date and time manually” button.

- Steer your cursor’s movement to your window’s bottom left corner and pick the lock icon. It will prompt a wizard to emerge on your screen, which will request your administrator password. This step will conclude after you move to the system date and time tab.

- While you can toggle your date and time settings whenever you like, you can also opt for an appropriate time zone for your device. Configure these settings via the map or the “Time zone” section in Date and Time Preferences.

Hopefully, after you play around with the date and time settings and correct everything, you will stop getting QuickBooks error 2308. However, if you see the issue persisting, there’s no harm in trying other solutions.

Recommended to read : How to resolve QuickBooks Abort Error

Solution 2: Add QuickBooks and Intuit To the Trusted Sites List in Internet Explorer

Security concerns may prompt Internet Explorer’s settings to consider QuickBooks and Intuit dangerous websites. However, you can alter these settings to your preference through the following actions:

- Let Internet Explorer run freely on your computer.

- Once it commences and functions well on your device, you need to head to the gear icon in the browser window’s top-right corner to unfurl the Tools menu.

- The Tools menu will have a dropdown options list from where you must opt for “Internet options.”

- Now, as you navigate the Internet Options window, place your cursor on the “Security” tab to choose it.

- Within the Security tab, you will discover four zones: Internet, Local intranet, Trusted sites, and Restricted sites.

- Your job is to pick the “Trusted sites” zone, followed by hitting the “Sites” button.

- These steps will push the Trusted Sites window to emerge on the screen. Here, you are supposed to uncheck the “Require server verification (https:) for all sites in this zone” option.

- Now, you’ll reach the “Add this website to the zone” field. Here, you should proceed by inputting the following websites one by one and tapping the “Add” button after each entry:

- For Intuit: https://*.intuit.com

- For QuickBooks: https://*.quickbooks.com

- Once you’ve concluded adding both websites, the “Close” button in the Trusted Sites window will lead you out of this stance.

- Now, you’ll return to the Internet Options window, where you must confirm these modifications by picking the “OK” button.

- Conclude the entire IE configuration settings process by restarting the device, picking Internet Explorer, and letting the changes affect everything.

As you configure to add Intuit and QuickBooks to the trusted sites list, you let Internet Explorer trust these websites and encourage certain features or functionalities to work correctly. However, a noteworthy statement is that the steps mentioned above are specific to Internet Explorer and may differ slightly for other browsers. Hopefully, your QuickBooks error 2308 won’t arise after trying these processes.

Solution 3: Review and Manage Your QuickBooks Firewall Settings

Your QuickBooks firewall settings will require the necessary configuration once you encounter QuickBooks error 2308. It is because Windows Firewall may consider the program a threat, thus, treating it as a poor program and not giving it exclusive rights to work with an internet connection and robust network.

Thus, the following settings in the application will assist in adjusting this aspect and preventing error 2308 from arising:

Step 1: Determine your firewall software

The primary thing to verify is outlining which firewall software you have installed on your device. The standard firewall programs prevalent and utilized the most by industries include Windows Firewall, McAfee, Norton, AVG, etc.

Step 2: Scan system requirements

The next step after knowing your current antivirus system includes reviewing the compatibility between firewall software and the version of QuickBooks you are using. It would involve you inspecting the QuickBooks documentation or the Intuit website for specific system requirements.

Step 3: Add QuickBooks to the firewall exceptions or exclusions list

Once the compatibility aspect is set, you can configure your firewall to permit QuickBooks access to the network. Although the steps for this process vary depending on your firewall software, generally, you’ll need to add QuickBooks executable files to your firewall’s exceptions or exclusions list. The QB executable files are typically located in the QuickBooks installation folder, which doesn’t require much effort to be found.

Step 4: Set the appropriate firewall permissions

While managing the firewall settings, you must ensure that QuickBooks has the required permissions to communicate over the network. It would involve authorizing incoming and outgoing connections for QuickBooks-related processes and studying your firewall settings to enable these permissions.

Step 5: Enable specific ports

An avid QuickBooks user must complete these settings beforehand and involve specific ports to be open for proper functionality. If you need to refer to the QuickBooks documentation or Intuit support for the particular port numbers and protocols required, so be it. Your task is to configure your firewall to open these ports or create port forwarding rules.

Step 6: Network diagnosis tool (optional)

If you’ve been utilizing QuickBooks for a long, you know it provides a network diagnosis tool that can help you identify and resolve firewall-related issues. This tool is accessible via the QuickBooks Tool Hub > Network Issues > Network Diagnostic Tool. As you operate the tool and respond to the on-screen instructions, it runs, diagnoses, and fixes all the network-related problems in your device.

Step 7: Test QuickBooks connectivity

After configuring the firewall settings, test the success of these settings by launching the QuickBooks program and performing steps to ensure that it can access the network and relevant services. The features you can test include:

- Downloading updates

- Accessing company files over the network

- Using QuickBooks in a multi-user mode

After all these steps are accomplished, review the presence of error 2308 in your system.

Bottom Line

This in-depth QuickBooks error 2308 removal guide should offer you relief from the annoying glitch grasping your system. However, if you continue struggling with the error, you’re free to consider our Proadvisor Solutions’ professionals at 1.855.888.3080, as they take you out of this trouble seamlessly.

FAQs

How can I prevent QuickBooks error 2308 from occurring in the future?

To prevent encountering this error, you can take the following preventive measures:

1. Ensure accurate bank account information is entered into QuickBooks Payroll.

2. Keep your bank account information up to date in QuickBooks.

3. Regularly review and verify the authorization for accessing your bank account.

4. Perform regular bank reconciliations within QuickBooks.

5. Stay updated with the latest software and service updates from Intuit.

6. Maintain a stable and reliable internet connection when using QuickBooks Payroll.

By following these measures, you can minimize the chances of encountering glitches while running and submitting QuickBooks Payroll and ensure smooth payroll processing.

What is the error code 2300 in QuickBooks Desktop?

Error code 2300 in QuickBooks Desktop is something that you stumble upon when submitting payroll. This could be because the banking information you entered for the employee is not correct. Therefore, check the employee’s direct deposit information.

How to prevent future occurrences of QuickBooks error code 2308?

To prevent QuickBooks error code 2308 from showing up in the future, you need to follow some healthy practices. These include updating your QuickBooks application and tax table regularly, keeping accurate employee banking details and information, and updating your operating system. Moreover, ensure that Windows or an antivirus firewall doesn’t interrupt QB programs.

Why is my QuickBooks payroll not working?

QuickBooks Payroll might fail to work properly if your software or tax table is outdated. If your payroll subscription is inactive, you might also face a problem. Other reasons could be an unstable or poor internet connection, a firewall, or antivirus blocking.

Can QuickBooks Tool Hub help fix error 2308?

Error code 2308 is related to payroll, and QuickBooks Tool Hub is not designed to troubleshoot that. However, there are some things you can do to resolve it, such as checking your network connection and payroll service subscription and updating QB Desktop and the tax table.

Read more helpful articles :-

How to fix QuickBooks Payroll Most Common Errors

Payroll service connection errror in QuickBooks

How to Fix Payroll Mistakes in QuickBooks? (Answered)

How to Fix QuickBooks Payroll Error PS034

How to Fix QuickBooks Error PS032 (Expert Tips)

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.