QuickBooks Payroll error 2107 is a direct deposit error that can make you unable to send paychecks to your employees via direct deposit. It often occurs due to an incorrect payroll Setup or direct deposit configuration, a damaged or corrupted Windows registry, or an unstable internet connection. The error can appear with any of the following error messages:

Payroll Service Server Error. Please try again later. If this problem persists, please contact Intuit.

Payroll Connection Error.

Error: QuickBooks Desktop has encountered a problem sending your usage data.

In this blog, we’ll discuss the in-depth troubleshooting methods you can use to resolve the QuickBooks error code 2107. First, let’s talk about the causes of the 2107 error.

Are you unable to send your direct deposit via QuickBooks Payroll? Contact our Proadvisor Solutions expert at 1-855-888-3080 today to resolve your issue in no time!

Table of Contents

Potential Causes of the Payroll Error 2107 in QuickBooks

Finding the root cause of any error is necessary before trying to fix it. Hence, we have listed for you the factors that can potentially trigger the QuickBooks error 2107 to appear on your screen:

- The settings related to Internet security and personal firewall software hinder the payroll functions.

- Incorrect installation of the QuickBooks application can be a reason for the QuickBooks Payroll Error 2107.

- Essential files needed for the working of QuickBooks have been deleted unknowingly. As a result, the work process of the QB Payroll is disrupted.

- A damaged or corrupted Windows registry can also cause this error.

- Your system is affected by a virus or malware. This could have corrupted your QuickBooks or Windows files.

- The installation file linked to QB Desktop has been damaged.

- You are in the multi-user mode when sending the payroll data.

- A network time-out can come in the way of QB Desktop reaching the server and hence cause QuickBooks Error Code 2107.

- An unstable internet connection can also cause this issue.

You may also read: I am getting QuickBooks payroll Error PS034

Troubleshooting Methods to Fix Payroll Direct Deposit Error 2107 in QuickBooks Desktop

Now that we know about the causes of the QuickBooks Payroll error 2107 in QB Desktop, let’s proceed to list the methods you can use to troubleshoot it. Make sure to follow each step carefully.

Method 1: Update the QuickBooks Desktop App to the Latest Released Version

Updating the QuickBooks Desktop application ensures that you fix any technical bugs or glitches present in the software. The first method you should implement for fixing the error code 2107 in QBDT is updating it. Before heading over to the process of updating the QB Desktop application, first review if it is already updated with the steps given below:

Note: Updating the QuickBooks application will only lead to small changes and improvements. This might not fix the error 2107; however, it is a good practice to update your app to eliminate any bugs that can potentially be behind this error.

- Launch the QuickBooks Desktop app.

- Use the F2 (or Ctrl+1) keys to open the Product Information window.

- Match your QuickBooks application’s current version and release year with the latest one (you can check the latest version online).

If you are using an outdated version of the QB Desktop application, you must follow the steps below to update it:

- If open, close all your company files and exit the QuickBooks app.

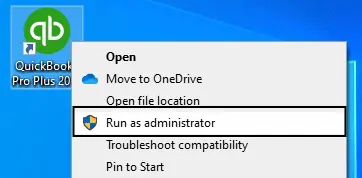

- Open the Start menu on your PC and search for the QB Desktop application.

- Right-click on the icon and choose Run as administrator.

- You will see the No Company Open screen appear in front of you.

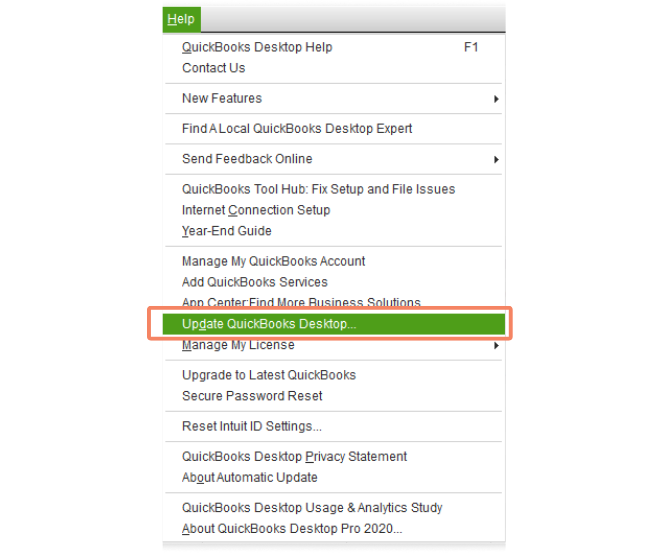

- On the window, navigate to the Help menu.

- Choose the Update QuickBooks Desktop option.

- Select the Options tab and click on Mark All.

- Finally, choose the Save option.

- Navigate to the Update Now tab and click on the Reset Update checkbox.

- Hit the Get Updates button.

Reopen QuickBooks after the process completes. Press the Yes option to install the updates and restart your QBDT app. This would fix the QB error code 2107.

Method 2: Configure the Windows Firewall Settings to solve Error 2107 in QuickBooks Payroll

Once you have updated the QB Desktop application to the latest released version and are still facing the QuickBooks Payroll error 2107, you can configure the Windows Firewall to fix it with the following steps:

- Use the Windows key to open the Start menu

- Type Windows Firewall in the search bar

- Open the Windows Firewall

- Click on Advanced Settings

- Right-click on Inbound Rules

- Select New Rule

- Click on Port and press Next

- Ensure that TCP is selected

- Now, type in the port for your QBDT version in the Specific local ports field:

- QuickBooks Desktop 2020 and above: 8019, XXXXX

- QuickBooks Desktop 2019: 8019, XXXXX

- QuickBooks Desktop 2018: 8019, 56728, 55378-55382

- QuickBooks Desktop 2017: 8019, 56727, 55373-55377

- After entering the port number, hit Next

- Ensure all profiles are marked if you are prompted

- Hit Next

- Create a rule

- Name it something like “QBPorts(year)”

- Press Finish

Now, repeat the steps to create Outbound Rules. This would resolve the error code 2107 in QuickBooks Desktop.

You may also see: How to fix QuickBooks payroll error 2002

Method 3: Check if the Earnings are Correct in the Payroll Center

You can check if the earnings are correct in the payroll center with the steps given below:

- Open the QuickBooks Desktop app

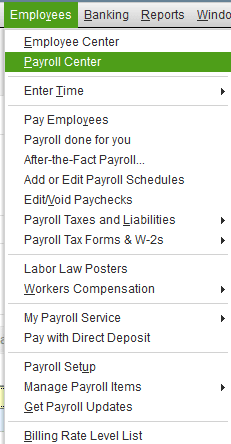

- Click on the Employees menu

- Select Payroll Center

- Press the Payroll tab

- Find the employee’s paycheck

- Go to the Payroll Information section

- Select the Open Paycheck Detail button

- Check if there are blank earning records

- Make the necessary changes and save them

This would resolve the error 2107 in QuickBooks Desktop.

Method 4: Utilize the QuickBooks Install Diagnostic Tool

You can use the QuickBooks Install Diagnostic Tool from the QB Tool Hub to resolve error code 2107 with the steps given below:

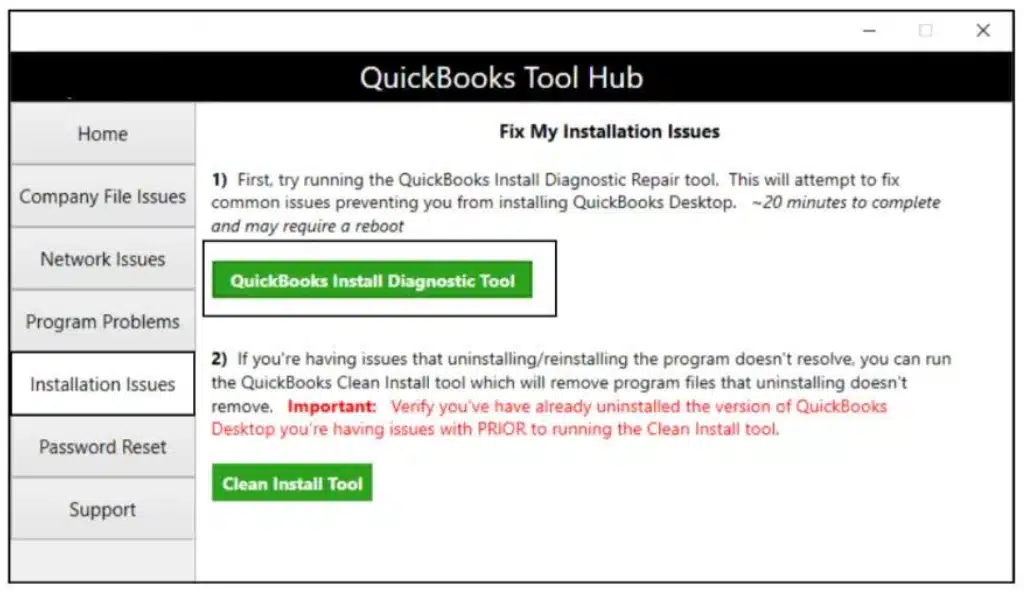

- Download and install the QuickBooks Tool Hub

- Open the QBDT Tool Hub

- Navigate to the Installation Issues tab

- Click on QuickBooks Install Diagnostic Tool

- Let the tool run

This would resolve the error 2107 in QB Desktop.

Method 5: Update Your Payroll and Tax Table to the Latest Version

You can use the QuickBooks Install Diagnostic Tool from the QB Tool Hub to resolve error code 2107 with the steps given below:

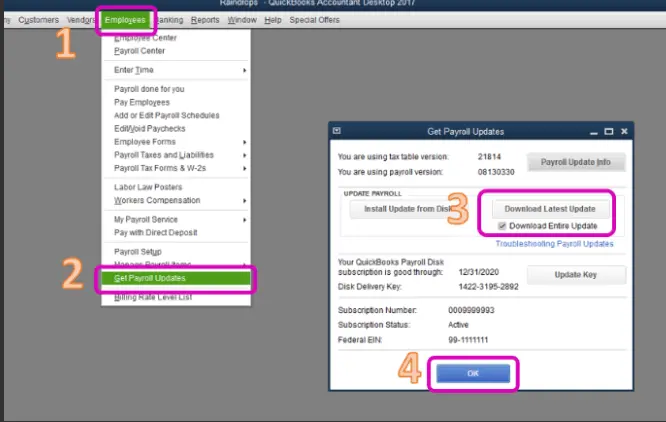

- Open the QB Desktop app

- Go to the Employees menu

- Click on Get Payroll Updates

- Press the Download Entire Update option

- Hit Update

- An informational window would appear after the update is complete

Now, the QuickBooks Payroll error 2107 has been fixed.

Method 6: Change Your Payroll Bank Account

You can encounter the QuickBooks Direct Deposit error 2107 if you have recently changed your bank account, but haven’t updated it in QB Desktop. To change your account, follow the steps given below:

STEP 1: Gather the Information Needed to Change Your Payroll Bank Account

- Gather your banking information

- Get your bank account number and routing number

- Do not use the routing number from deposit slips

- Note down your physical address

- Ensure that you have your payroll PIN with you

STEP 2: Set Up Your Bank Account in the Chart of Accounts

- Open the QuickBooks Desktop app

- Navigate to the Lists menu

- Click on Chart of Accounts

- Select Accounts

- Press New

- Select the Bank option

- Press Continue

- Enter your banking information

- Hit Save and Close

STEP 3: Find Any Pending Tax Payments or Payroll Transactions

- Open QBDT and click on the Employees menu

- Select Payroll Center

- Now, click on the Payroll tab

- Verify and clear any pending payroll transactions

STEP 4: Change the Bank Account in QBDT

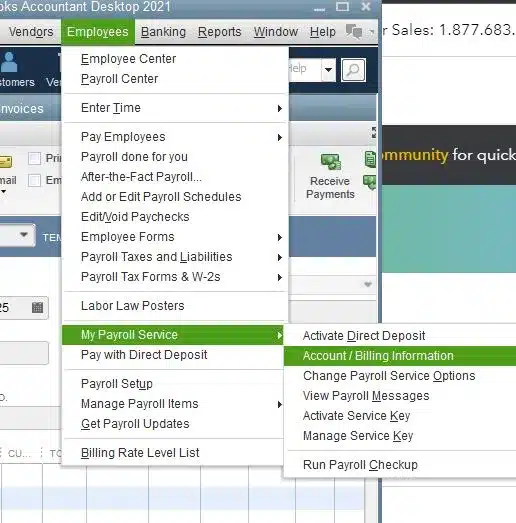

- Open the Employees menu

- Click on My Payroll Service

- Select Account/Billing Information

- Sign in with your Intuit account

- Navigate to Payroll Info

- Under the Direct Deposit Bank Account, select Edit

- Type in your payroll PIN

- Hit Continue

- Enter your new banking info

- Press Update

- Hit Close after receiving the confirmation message

STEP 5: Verify Your Bank Account

Intuit will verify your bank account within 2-3 business days with a test transaction of less than $1. Given below are some things to keep in mind before verifying your bank account for QB Direct Deposit:

- The test transaction will appear in your account statement within 2-3 days

- The transaction would be a debit and credit amount of less than $1

- Check your bank statement online to verify the amount

- Ensure the transaction is cleared before verifying the amount

After keeping the above-given things in mind, follow these steps:

- Open the QBDT app

- Navigate to the Employees menu

- Click on My Payroll Service

- Select Account/Billing Information

- Sign in using your Intuit account

- Go to the Payroll Info section

- Select Verify under Direct Deposit Bank Account

- Enter your payroll PIN

- Confirm it

- Press Submit

- When you receive the Your bank account is verified message, click on Return to QuickBooks

STEP 6: Change the Default Bank Account in QuickBooks Preferences

- Open QuickBooks Desktop

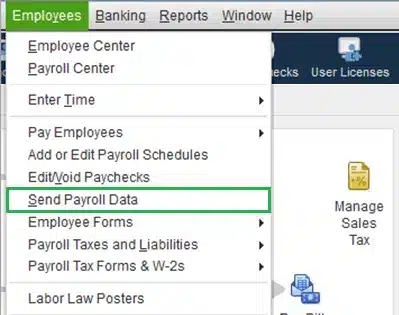

- Then, click on the Employees menu

- Press Send Payroll Data

- The Send/Receive Data window will open

- Select Preferences

- Go to Account Preferences

- Choose the new account from the dropdown menu

- Hit OK

- Select Close

Now, change your default bank account in the QuickBooks Payroll service liability check with the following steps:

- Open the Employees menu

- Click on Send Payroll Data

- Press Preferences

- The Payroll Service Accounts window would open

- Click on the Pay Payroll Liabilities with dropdown menu

- Select your new bank account

- Hit OK

- Press Send and enter your payroll PIN

Now, the problem of QuickBooks Payroll error 2107 would be fixed.

Method 7: Check Your Company’s Legal Name

Having special characters in your company’s legal name can lead to you seeing the QuickBooks Payroll error code 2107. Fix it by checking your company’s name with these steps:

- Open the QB Desktop app

- Navigate to the Company menu

- Select the Company Information option

- Change the Legal Name

- Eliminate any special characters you see

Performing these steps would resolve error 2107 in QB Desktop.

QuickBooks Payroll Error 2107 – A Quick View Table

Given in the table below is a concise summary of this blog on the topic of the QuickBooks Direct Deposit error 2107:

| Description | The QuickBooks Payroll error code 2107 is a direct deposit error that can render you unable to deposit paychecks into your employees’ bank accounts. This can hamper your workflow and important business processes. |

| Its causes | Incorrect installation of the QBDT app, deleted files needed for QB Payroll to work, a damaged or corrupted Windows registry, using multi-user mode while sending payroll data, an unstable internet connection, and the Firewall blocking QB. |

| Ways to fix it | Update the QB Desktop app, make Windows Firewall exclusions for QB, verify if the earnings are correct in the Payroll Center, use the QuickBooks Install Diagnostic Tool, update your payroll and tax table, change the payroll bank account, and check your company’s legal name. |

In a Nutshell

In this blog, we talked about the QuickBooks Payroll error 2107, along with the potential factors that can trigger this problem to pop up on your screen. Additionally, we also provided you with the in-depth step-by-step troubleshooting methods you can use to resolve this error on your own. If you are still facing the same issue, feel free to contact our Proadvisor Solutions experts at 1-855-888-3080 to resolve it in no time!

FAQs

Why am I seeing the QuickBooks error 2107 on my screen?

The reasons you might be seeing the QuickBooks error are given below:

1. An outdated QBDT app

2. The Firewall is blocking QuickBooks

3. Damaged or corrupted Windows registry

4. Installation issues with the QB Desktop app

How can I fix the error 2107 in QuickBooks Desktop?

The troubleshooting methods to fix the error 2107 in QBDT are given below:

1. Update the QB Desktop app

2. Configure the Windows Firewall for QB

3. Check if the earnings are correct in Payroll Center

4. Use QuickBooks Install Diagnostic Tool

5. Update the payroll and tax table

6. Change the payroll bank account

7. Verify your company’s legal name

You must read this :-

How to Rename Company File in QuickBooks

How to fix QuickBooks Error PS038 : Stuck Paychecks

How to Fix QuickBooks Desktop Freezing Up Issue?

Fixing QuickBooks Desktop has Reached the Expiration Date

Understanding the QuickBooks Subscription Renewal Process

Erica Watson is writing about accounting and bookkeeping for over 7+ years, making even the difficult technical topics easy to understand. She is skilled at creating content about popular accounting and tax softwares such as QuickBooks, Sage, Xero, Quicken, etc. Erica’s knowledge of such softwares allows her to create articles and guides that are both informative and easy to follow. Her writing builds trust with readers, thanks to her ability to explain things clearly while showing a real understanding of the industry.